It is with a melancholy heart that the following observation is made: terrorism is more than ever still a very real threat. Immigration policy remains high on the ‘finger-pointing’ list for being a contributing factor. A fair comment? It’s far from an easy one to call. Recent press will show that proposals have been made to put in place effective legislation in an attempt to control the terrorist threat levels in the UK. The resulting Counter Terrorism and Security Bill passed a second reading in the House of Commons on 2 December and is currently being considered by a Committee of the whole House. Continue reading “The Counter Terrorism and Security Bill”

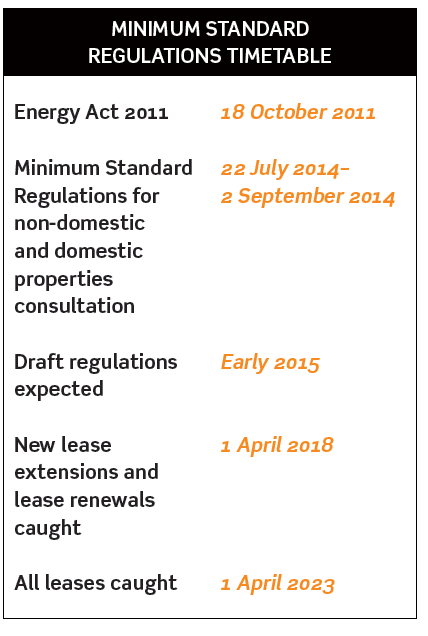

Minimum energy efficiency standard for commercial buildings: issues for landlords and tenants

The government is expected to produce draft regulations to introduce a new minimum energy efficiency standard for non-domestic and domestic rented buildings. Continue reading “Minimum energy efficiency standard for commercial buildings: issues for landlords and tenants”

Fraudulent misrepresentation: ‘positive evidence’ needed to rebut presumption of inducement

The High Court’s decision in Richard Edwards v Jahit Ahmet Ashik [2014] has provided useful guidance on what is required to rebut the presumption that fraudulent pre-contractual representations are taken to have induced the recipient into entering a contract. Timothy Fancourt QC, sitting as a Deputy High Court Judge, held that positive evidence that the representee was not in fact induced to act by the misrepresentation is required for such purposes and merely proving on a balance of the probabilities that the representee would have proceeded in the same manner anyway would not be enough. The Deputy Judge also confirmed that, in order to rebut the presumption, a representor does not need to go as far as demonstrating that the misrepresentation played no part at all, but they have to show that it did not play a real and substantial part in the decision to enter the agreement. Continue reading “Fraudulent misrepresentation: ‘positive evidence’ needed to rebut presumption of inducement”

Scottish charity law

Charities and philanthropy continue to have important roles in commercial and public life. Charitable organisations are now used to undertaking a wide array of services and activities that historically would not have been immediately associated with the charities sector. In Scotland, we are nearing the end of the first decade of having in place a Scottish charity regulator, with ever increasing focus on strong governance to underpin a flourishing charities and third sector, and to encourage philanthropy, both individually and by corporates. All of these factors can bring in-house lawyers into contact with charity law issues. Continue reading “Scottish charity law”

Article 8 defences to possession claims

The Human Rights Act (HRA) 1998 enshrines various rights derived from the European Convention for the Protection of Human Rights and Fundamental Freedoms in the law of England and Wales. For defendants facing a claim for possession, the rights under Article 8 of the Convention may offer a possible defence. Whether such an argument can be advanced will depend partly on the ground on which possession is sought, and partly on whether the claimant is a public authority or a private landowner. Continue reading “Article 8 defences to possession claims”

Brussels flexes its muscles in support of forum choice clauses

‘Jurisdiction’ is the power of a court to entertain an action or other proceeding. When parties enter into a transaction they usually include a ‘jurisdiction clause’ alongside a ‘governing law clause’ to determine where and subject to which country’s laws, any future issues should be determined. Continue reading “Brussels flexes its muscles in support of forum choice clauses”

Buying businesses from administrators: now is the time to prepare

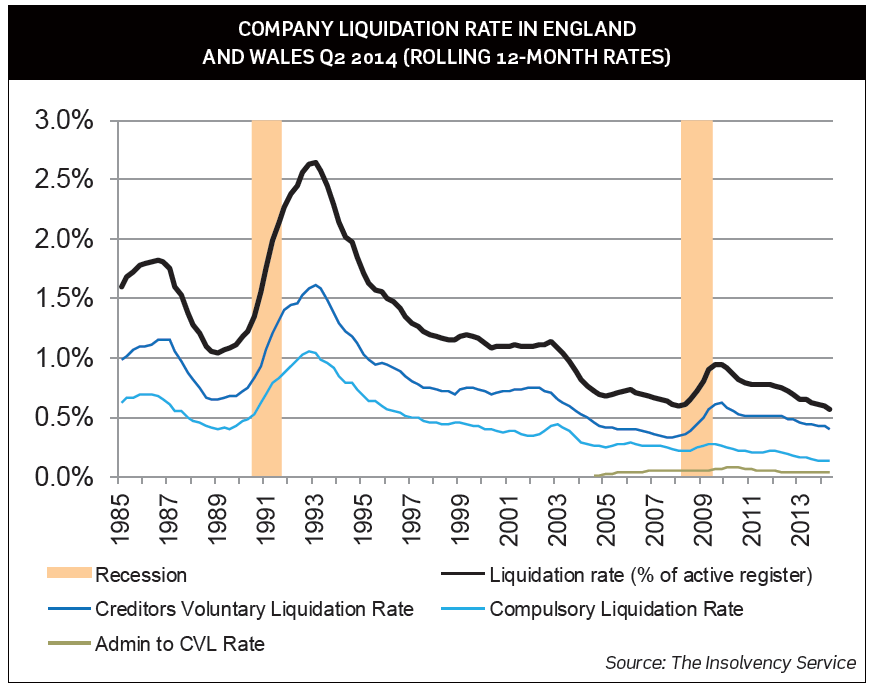

As daily news heralds the emergence of the British economy from the worst recession since the 1930s it may seem a strange time to suggest that companies should consider acquiring businesses from companies which go into an insolvency process.

However, looking back at past recessions shows that, apart from a spike of insolvencies when the recession first bites, the peak of insolvencies occurs a surprisingly long time after the economy has returned to growth. For example, the global recession is the early 1980s ended in the UK at the beginning of 1981 but the peak of company failures did not occur until 1985. Similarly, the UK economy technically emerged from a recession in the third quarter of 1991 but corporate insolvencies did not peak until the end of 1992. Continue reading “Buying businesses from administrators: now is the time to prepare”

Back to the future: the only constant in life is UK immigration law

Heraclitus was probably right when he said in 500BC that ‘the only constant in life is change’. However, if he was living or working in the UK today as an overseas national, he would probably rephrase this by saying that the only constant is UK immigration law, judging by the frequency with which it changes. Continue reading “Back to the future: the only constant in life is UK immigration law”

Engine emissions from non-road mobile machinery: changes to regulatory regime on the horizon

Non-road Mobile Machinery (NRMM), which covers a wide array of different types of machinery from construction machinery and locomotives to garden equipment, is currently subject to specific air quality legislation. This article outlines the current regime and then discusses new European Commission proposals for a revision of the EU-wide law applied to NRMM. The changes are of particular importance to manufacturers and distributors of engines for NRMM along with end users of NRMM across a number of different sectors. Continue reading “Engine emissions from non-road mobile machinery: changes to regulatory regime on the horizon”

Is it time for a friendly discussion?

Contracting parties have increasingly been agreeing to commit themselves to some form of inter partes discussion prior to the issuance of formal proceedings. This is despite the courts’ historic lack of inclination to find such dispute resolution clauses to be enforceable. However, this looks set to change: in Emirates Trading Agency LLC v Prime Mineral Exports Private Ltd [2014] the Commercial Court distinguished the case from leading case law in this area and held that an obligation on the parties to enter into ‘friendly discussions’ before commencing formal proceedings was an enforceable term of the contract. Continue reading “Is it time for a friendly discussion?”

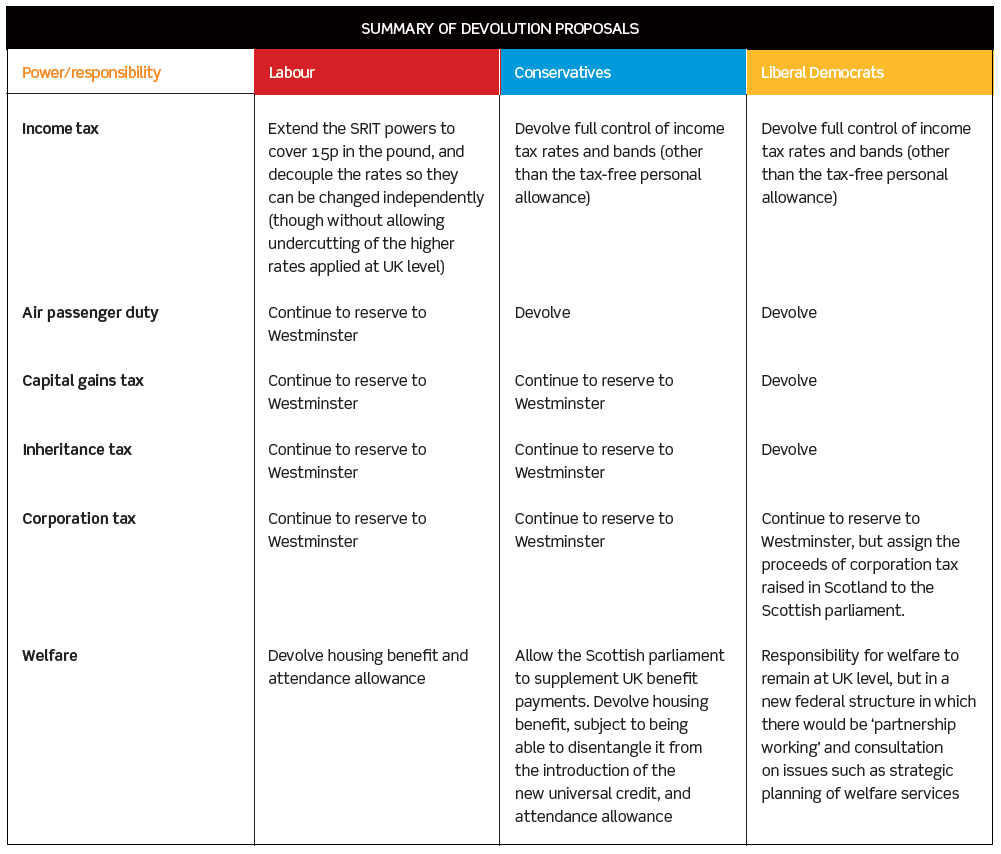

Constitutional debate rumbles on after ‘no’ vote

On 18 September 2014, Scotland voted ‘no’ to the question ‘Should Scotland be an independent country?’. That has not meant an end to constitutional discussions and wranglings, however, with attention turning immediately to the further devolution of powers to the Scottish parliament.

The Scottish parliament will in any event be receiving new powers, with the Scotland Act 2012 having legislated to devolve taxes on landfill and property transactions, and an element of income tax. The Land and Buildings Transaction Tax (LBTT) and a new Scottish Landfill Tax will be introduced in April, with the Scottish Rate of Income Tax (SRIT) to follow in April 2016. The SRIT will see the main UK rates of tax (on non-savings income) reduced by 10p for ‘Scottish taxpayers’, with their rates then supplemented by the SRIT as fixed by the Scottish parliament. Continue reading “Constitutional debate rumbles on after ‘no’ vote”

Compulsory acquisition of land for in-house lawyers

This article outlines the law and procedure for the compulsory acquisition of land. It also gives some practical tips for in-house lawyers.

THE THREE PRINCIPAL STAGES OF ACQUISITION

There are three basic stages in compulsory acquisition. First, the conferment of statutory powers of compulsory acquisition upon an acquiring authority or other promoter. Second, the steps to acquire the land or interest for which powers have been conferred under stage one: this involves taking possession and obtaining title. Third, the preparation and submission of claims for compensation, and dealing with the heads of losses for which compensation is payable. Continue reading “Compulsory acquisition of land for in-house lawyers”