History does not stand still, so nor does intellectual property law. 2016 and so far in 2017 we have seen change and the indication of upheaval to come.

Continue reading “Intellectual Property – Comparative Guide Introduction”

Real estate transactions — GST inclusive or exclusive?

The goods and services tax (“GST”) has been with us since 1 April 2015 and we have seen its impact on various parts of our lives. In theory, it is a relatively straightforward tax regime that can nevertheless prove difficult in practice, especially in relation to GST on real estate transactions.

Continue reading “Real estate transactions — GST inclusive or exclusive?”

Sales tax refund

When the goods and services tax (GST) was first introduced to replace the general sales tax and service tax regimes in 2015, the overarching concern for businesses was the implementation and administrative aspect. As companies scrambled to understand the rules and procedures in order to facilitate the rollout of GST, many, if not all, would have neglected or overlooked the fact that this transition would trigger a double collection of taxes for goods still held as stock across both tax regimes.

Similar means, different goals to achieve same end: customs valuation and transfer pricing

The enforcements of customs valuation and transfer pricing are the epitome of similar means and different goals to achieve the same end. The means of valuation and pricing are similar in the form of the valuation and pricing methodologies. However, the goals are at two ends of the spectrum: the former wants the highest appraised value of imports; the other, the lowest possible level to maximise taxable profits. Such paradoxical treatments are largely unregulated, not less due to regulators themselves being beneficiaries of the ultimate end in the form of higher revenue collection.

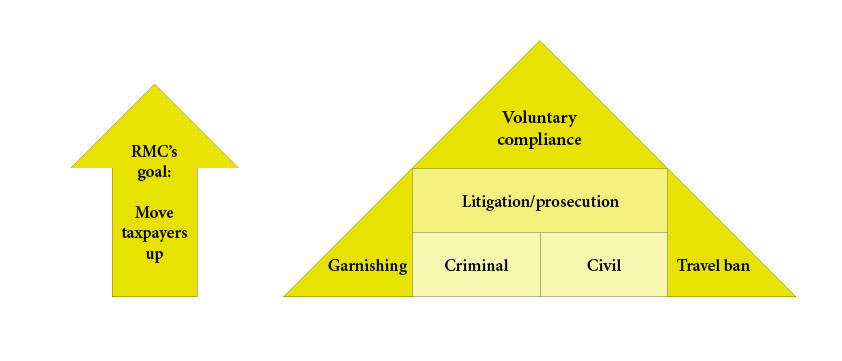

Cultivating Good GST Compliance Culture via CBOS 3.0

When we ordinarily refer to compliance in goods and services tax (GST), what strikes our minds is the filing of GST returns and settling the GST due within the stipulated taxable period. It has been more than two years now since the implementation of GST in Malaysia. The compliance rate for GST filing thus far has been high, with an average rating of above 95%.

Continue reading “Cultivating Good GST Compliance Culture via CBOS 3.0”

Fit to Print

In a world where newspapers are branding judges ‘enemies of the people’ and fake news dominates public discourse, these days the media itself is the story.

The blueprint

‘There are known knowns… There are known unknowns… but there are also unknown unknowns.’

Shattered

‘When I initiated discussions on our culture at partners’ meetings, I could see the faces of many of my former partners light up, not for the reasons I hoped, but from the reflected glow of their BlackBerrys. They saw an excellent opportunity to catch up on more pressing issues, while I, to their minds, embarked on some abstruse philosophical and largely meaningless examination of our corporate soul.’ David Harrel, senior partner of SJ Berwin between 1992 and 2006, writing in Legal Business, 2013

The shock of the new

At a recent event for senior in-house counsel in London, two clear messages emerged. Firstly, that there is a rapid professionalisation in the way that major legal departments are managing themselves. Secondly, there was agreement that much of the support for change was being driven from the ‘alternative’ legal market. Despite this, there was a lack of agreement as to what lay behind this process and how alternative providers were supporting it. In this article we explore these two issues. Firstly, what are the changes in-house legal departments are looking to bring about? And, secondly, how can the alternative marketplace help support them? Continue reading “The shock of the new”

Rebels with a clause

For classists, the word ‘disruptive’ still carries negative connotations of damage, chaos and disarray. But these days in corporate circles it has become the phrase of the day – a complimentary shorthand to describe tech-driven innovators remaking all manner of industries. But the cult of disruption – birthed in Clayton Christensen’s hugely influential 1997 book The Innovator’s Dilemma – has truly come of age when it has reached not only the legal profession, but its in-house branch.

The new black

In her much-touted new book on bolstering team-working in professional services, Smart Collaboration, Harvard Law School professor Heidi Gardner argues that sophisticated buyers are increasingly expecting an open-house approach from advisers in delivering their wares.

Managing risk: the in-house view

DAC Beachcroft and The In-House Lawyer recently conducted a survey to assess the role and influence of the in-house lawyer in managing risk. Is the role that of ringmaster – right at the heart of the matter – or more a side-line prompt? Essentially does the legal department have the necessary influence, associations, and information to fulfil the role of business adviser effectively? A picture emerges of the in-house lawyer as a key player in risk management and important contributors to the risk process, albeit that they own few risks. Continue reading “Managing risk: the in-house view”