Where a contract is formed on the basis of a mistake as to the law or certain facts, the contract can potentially be deemed void from its inception. In certain circumstances, however, the court has the authority to remedy the mistakes, by construing the contract in a way that will correct the mistakes, or by rectification. Continue reading “Make no mistake: High Court refuses to rectify erroneous contract”

BSkyB / News Corp and Ryanair / Aer Lingus: The Long-Reach of UK Merger Control

Two recent high-profile cases involving BSkyB/News Corporation and Ryanair/Aer Lingus have highlighted the importance of the merger control rules. These cases have also demonstrated the extensive scope and potential flexibility of the UK merger control regime and why anyone considering the acquisition of even a minority stake in a business may need to consider competition issues. Continue reading “BSkyB / News Corp and Ryanair / Aer Lingus: The Long-Reach of UK Merger Control”

UAE investment funds: proposed regulations

On 6 January 2011 The Emirates Securities and Commodities Authority (ESCA) released a new draft regulation on investment funds in the UAE (the Regulation) for public consultation. The deadline for submitting comments or responses to ESCA is now closed, and it is expected that the Regulation will soon be discussed and approved by ESCA.

It is hoped that the Regulation, along with the existing and upcoming securities laws administered by ESCA, will provide a better regulatory environment for the issuance of domestic investment funds, as well as the distribution of foreign funds in the UAE. Continue reading “UAE investment funds: proposed regulations”

Enforcing Trade Marks Online – Stemming the Flood

It’s Friday, 8:30 AM, and you’re eating breakfast at your desk. Overnight you have received an urgent e-mail from Bob Shine, vice-president of Business Affairs. Bob is based in your head office several time zones away. For the past nine months you have been assisting him with due diligence in the divestment of one of your major brands to another large multinational. The negotiations are in their final stages. Continue reading “Enforcing Trade Marks Online – Stemming the Flood”

How does insurance respond in times of social and political upheaval?

With much of the Arab world going through political and social upheaval, oil and commodity prices rising sharply, and sky-rocketing food prices putting much of the world’s population back into extreme poverty, the risk of increased civil unrest occurring across the globe is a real possibility. In anticipation of such an event, multinational companies need to ensure that they not only have appropriate risk management and response procedures in place to protect their employees, but that they also have adequate insurance to protect their balance sheets. Similarly, (re)insurers need to carefully review their underwriting exposures, particularly regional accumulations and aggregations, to maintain the functionality on which most of global business depends. Continue reading “How does insurance respond in times of social and political upheaval?”

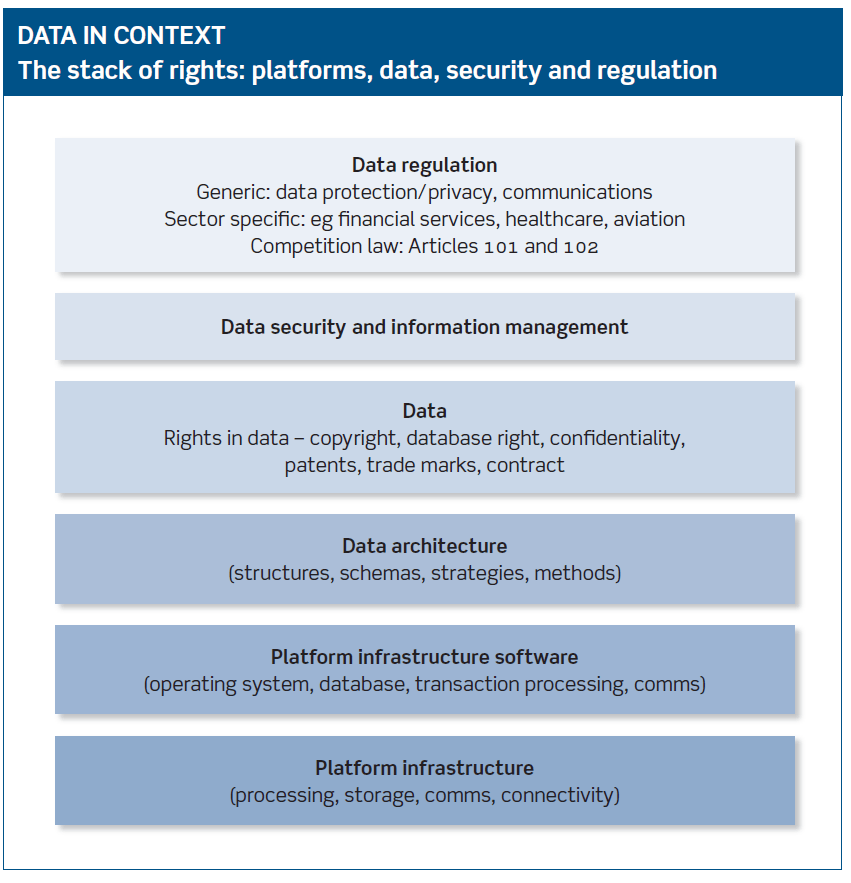

Data law and the ‘data-centric world’

This is Kemp Little’s first contribution to In-House Lawyer, and the firm is delighted to be involved in the IT, telecommunications and outsourcing area. The first topic, which the firm anticipates returning to in further editions this year, is data law and the ‘data-centric world’. Continue reading “Data law and the ‘data-centric world’”

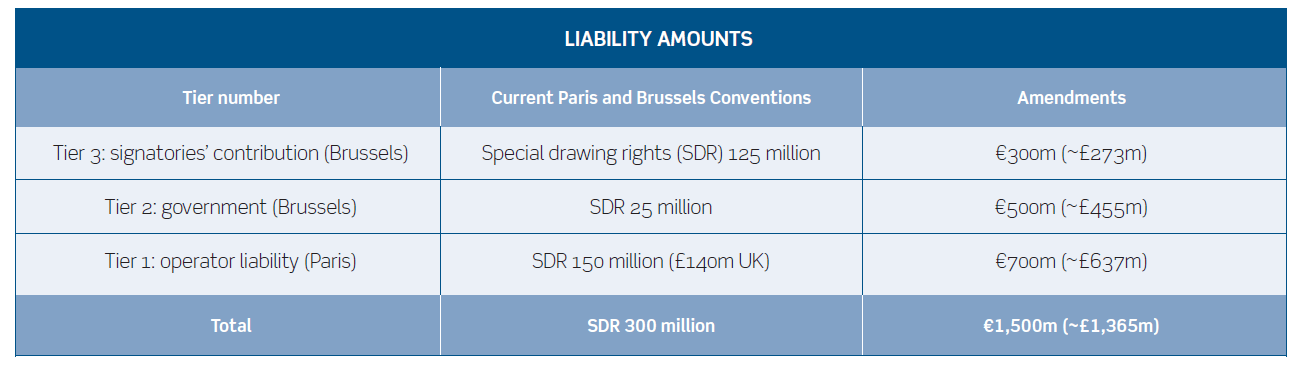

Major developments in UK nuclear liability legislation

Substantial changes to current legislation governing nuclear liability in the UK are afoot, following the recent release of the government’s public consultation ‘Implementation of changes to the Paris and Brussels Conventions on nuclear third party liability’ in January (the consultation). The proposed amendments are significant and will impact throughout the nuclear sector, from those involved in decommissioning and the transport of nuclear material, through to new build. Continue reading “Major developments in UK nuclear liability legislation”

Is the UK a desirable holding company location?

Various corporate groups have recently relocated or announced that they are considering relocating their holding companies from the UK to places such as Switzerland and Ireland. Talk of tax moves has become common place. Does this mean the UK is an undesirable place to base a global corporate group’s operations? This article suggests that the UK may not be such a bleak place to be located, but each group must consider its own circumstances. Continue reading “Is the UK a desirable holding company location?”

EMPLOYING PEOPLE IN SCOTLAND – WHAT DOES AN ENGLISH QUALIFIED IN HOUSE COUNSEL NEED TO KNOW?

In many respects employment law in Scotland is the same as that in England and Wales. Although Scotland has its own Parliament with law-making powers, the regulation of employment north of the border remains reserved by Westminster and those Acts with which English practitioners are familiar apply equally in the Scottish context. Continue reading “EMPLOYING PEOPLE IN SCOTLAND – WHAT DOES AN ENGLISH QUALIFIED IN HOUSE COUNSEL NEED TO KNOW?”

Lehman and Nortel : balancing the interests of the pension scheme and the unsecured creditors

In Bloom & Ors v The Pensions Regulator (Nortel, Re) [2010] in the High Court recently, Briggs J had to decide whether financial support directions (FSDs) and contribution notices (CNs) issued by the Pensions Regulator (the Regulator) to companies in administration or liquidation would rank as ‘expenses’ having super priority in the insolvency proceedings, or merely as provable debts ranking pari passu with other unsecured creditors of each company. Alternatively, if neither of these outcomes could be derived from the interaction between pensions legislation on the one hand and insolvency legislation on the other, the question was whether these pension liabilities would simply fall down a ‘black hole’. Bloom concerned the occupational pension schemes of Lehman Brothers Holding Inc and Nortel Networks, which were heard together in view of the common issues raised in both. There were applications before the court for directions by the administrators of 20 companies in the two groups. Continue reading “Lehman and Nortel : balancing the interests of the pension scheme and the unsecured creditors”

“Restricted” or “Unrestricted”, that is the question for UK Employers from April 2011

After an eventful end to 2010 for UK immigration practitioners, February 2011 saw the UK Border Agency (UKBA) publish a document entitled ‘Statement of Intent, Transitional Measures and Indefinite Leave to Remain’ (the statement). Continue reading ““Restricted” or “Unrestricted”, that is the question for UK Employers from April 2011”

New Incoterms: Incoterms® 2010 rules A brief look at the principal changes

The International Chamber of Commerce (ICC) sets standardised international commercial terms, the so-called Incoterms® rules, to facilitate international trade. The Incoterms are frequently referred to, for instance, in general terms and conditions, as well as in sales agreements governed by Dutch law. The former Incoterms were drawn up in 2000 and now a new version has been published: the Incoterms® 2010 rules. These new rules took effect on 1 January 2011. There are now 11 Incoterms rules (there used to be 13); four have been added and two removed. Every Incoterms® 2010 rule determines the risk transfer and contractual obligations applicable to the delivery of goods by sellers to buyers. They are therefore contractual arrangements about when a seller delivers goods to a buyer, who bears the transport risks, who pays the transport costs, and who is responsible for any customs and clearance formalities required. If reference is made to an Incoterms® 2010 rule, clarity is provided regarding each party’s responsibilities, which reduces the risk of legal issues. Important reasons for updating the Incoterms included the repeal of part of the US Commercial Code (UCC) and increased willingness in the US to use the Incoterms® 2010 rules. Continue reading “New Incoterms: Incoterms® 2010 rules A brief look at the principal changes”