The number of syndicated loans signed in EMEA in the first quarter of 2012 was less than half the number seen in the same period last year and the pipeline for the remainder of 2012 remains thin, bar any uptick in M&A activity. Banks are operating under tighter capital constraints and are increasingly selective on deals. For as long as market volatility persists, this seems set to continue. For those borrowers embarking on any form of financing in the current market, they are likely to find themselves treading a fine line between protecting their banking relationships (and locking in available liquidity) and signing up to a facility that is overly or unduly restrictive and that potentially prevents them from carrying out their day-to-day business without seeking bank consent. The aim of this article is to provide finance directors, treasurers and in-house counsel with an overview of some of the key issues they may face when negotiating a syndicated loan agreement in the current market and to highlight those areas where borrowers may wish to focus their efforts when negotiating with their banks.

Getting into hot water: renewable heat and the RHI

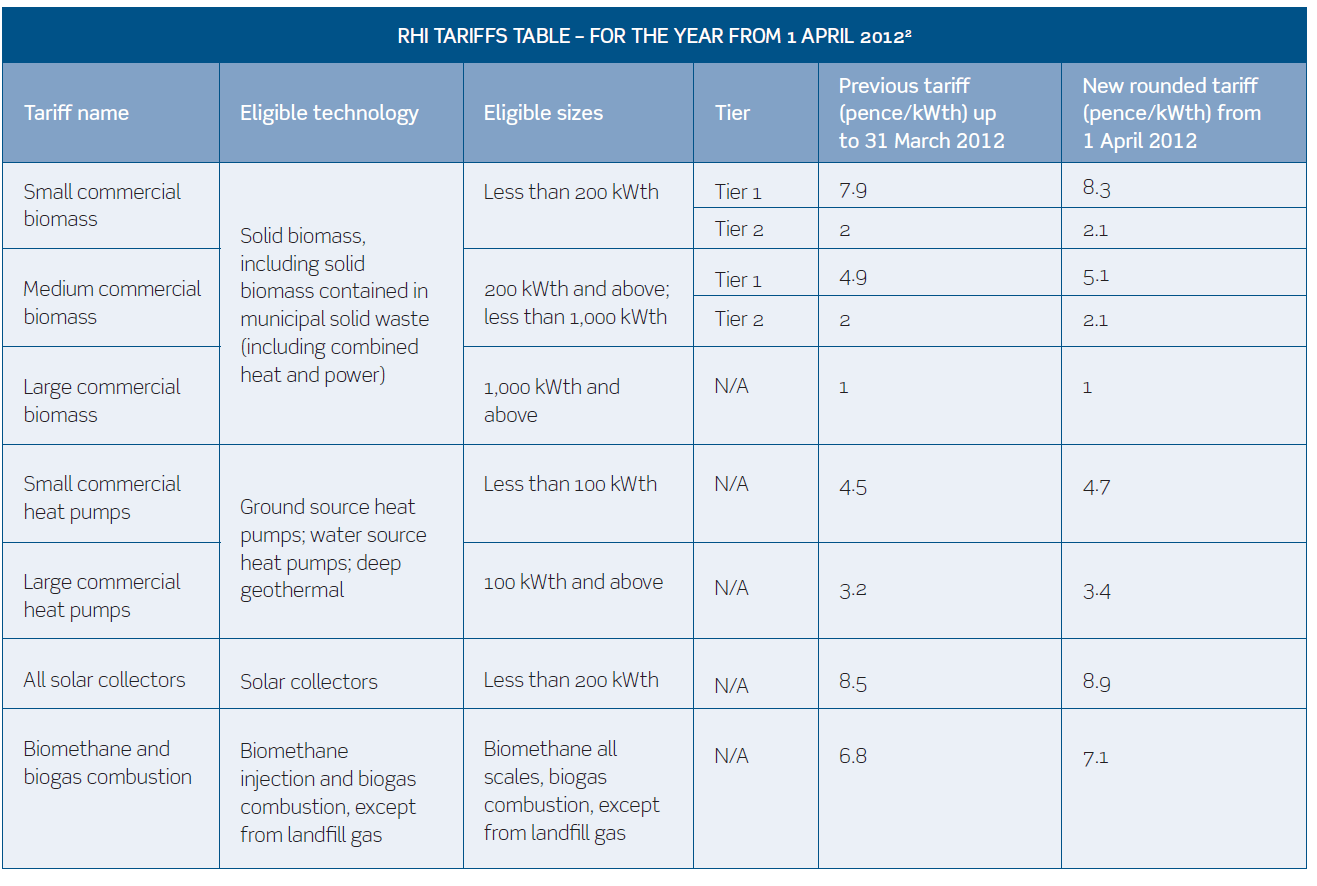

In April 2010 we considered the then proposed Renewable Heat Incentive (RHI) (The In-House Lawyer 179, page 7). Two years on, the RHI is in force and in this article we look at where the RHI has got to and consider some of the practical, commercial and legal issues around the RHI scheme and heat supply contracts.

Continue reading “Getting into hot water: renewable heat and the RHI”

High Court delivers knock-out blow to application for damages flowing from repudiatory breach

The High Court has ruled in favour of the Lonsdale group in two related summary judgment actions: Leofelis SA & anor v Lonsdale Sports Ltd & ors; and Trademark Licensing Company Ltd & anor v Leofelis SA (the Leofelis actions). The applications were in relation to claims stemming from alleged repudiatory breaches of a licence, which had been granted to Leofelis to allow it the use of Lonsdale-owned trade marks. The court decided that a breach of the licence, not known about by Leofelis at the time it had sought to terminate, could be relied upon as a defence to a claim for damages for wrongful termination, but not to found a claim for damages in respect of losses Leofelis alleged it had suffered after the date of termination.

Product liability and nanotechnology: an update

While the use of nanomaterials continues to grow, for some, concerns remain regarding the potential risks of using these materials and whether there is an adequate regulatory framework. Following up on an article published in The In-House Lawyer in May 2012, Sarah Croft, of Shook Hardy & Bacon International, assesses developments in the regulatory environment for nanomaterials and considers the product liability implications for manufacturers using them.

Continue reading “Product liability and nanotechnology: an update”

Calls on performance bonds: avoiding pitfalls

Calling on a performance bond should result in swift receipt of the bond amount by the beneficiary. However, there are risks involved in making calls on performance bonds, which can result in complex proceedings leading to delay and cost. Partners Richard Ward and Ben Bruton of Eversheds report on this area of law with attention given to issues highlighted by recent case law.

Continue reading “Calls on performance bonds: avoiding pitfalls”

Oil and gas decommissioning

According to the Department of Energy and Climate Change (DECC) statistics, within the United Kingdom Continental Shelf (UKCS) there are approximately 500 oil and gas installations, 10,000 kilometres of pipeline and over 10,000 wells. As an increasing number of these installations become redundant due to the depletion of oil field reserves, challenging issues are raised in terms of how decommissioning can most successfully be achieved, taking into account the environmental impact, available technology, waste management, high costs and multiple participants.

Procter & Gamble clean up in interpretation of paper towels sales contract

For anyone who thought that the courts would be more willing to imply terms into contracts following the Privy Council’s decision in Attorney General of Belize & ors v Belize Telecom Ltd & anor [2009] and the Supreme Court’s decision in Rainy Sky SA v Kookmin Bank [2011], the judgment in Procter & Gamble Company & ors v Svenska Cellulosa Aktiebolaget SCA & anor [2012] offers a timely reminder of the courts’ innate unwillingness to interfere in parties’ freedom to contract on whatever terms they wish.

Continue reading “Procter & Gamble clean up in interpretation of paper towels sales contract”

Kilted class actions

Class actions have been a hot topic in recent months due to a number of high-profile actual and threatened class actions south of the border. However, as things stand, class actions do not exist in Scotland. Would Scotland benefit from having a class action procedure and, if so, what form might it take?

Hot topics in commercial judicial review

Companies are increasingly using judicial review to protect valuable business interests. It is now routine for companies to challenge official decisions not only on the traditional grounds of illegality, irrationality and procedural unfairness, but also by invoking human rights principles and European law. When used effectively, commercial judicial review is a powerful tool. This article offers an overview of important recent trends.

Product liability and nanotechnology: an update

While the use of nanomaterials continues to grow, for some, concerns remain regarding the potential risks of using these materials and whether there is an adequate regulatory framework. Following up on an article published in The In-House Lawyer in May 2012, Sarah Croft, of Shook Hardy & Bacon International, assesses developments in the regulatory environment for nanomaterials and considers the product liability implications for manufacturers using them.

Continue reading “Product liability and nanotechnology: an update”

Is your Dutch joint venture shareholding safe and sound?

For tax reasons, international joint ventures are often structured by using a Dutch private limited liability company. As such, the joint venture company is governed by its mandatory articles of association. Besides the articles of association, the joint venture partners (shareholders) usually also enter into a separate joint venture or shareholders’ agreement to regulate the affairs of the joint venture and the obligations of each shareholder. Such agreements do not necessarily need to be governed by Dutch law, but can be governed by the laws of any jurisdiction. Regardless of what law governs the joint venture agreement, recent Dutch case law shows that shareholders can be forced to dilute.

Continue reading “Is your Dutch joint venture shareholding safe and sound?”

Gigantic noticeboard or wall of graffiti? Online libel: are we lost in analogy?

Following the recent High Court decision in Tamiz v Google Inc [2012], which closely followed the decision by HHJ Parkes QC in Davison v Habeeb [2011] just two months earlier involving the same defendant, you may have been mistaken for thinking that the law was for once attempting to move at the pace of technology. However, despite Mr Justice Eady stating in Tamiz that he was ‘striving to achieve consistency in the court’s decision making’, he appears to have come to a very different conclusion by holding that Google (as host of Blogger.com) was not (rather than arguably could be) a publisher at common law, regardless of notification.

Continue reading “Gigantic noticeboard or wall of graffiti? Online libel: are we lost in analogy?”