The beginning of any kind of internal investigation is a fraught time for in-house lawyers. Whether the investigation has been triggered by suspected corrupt conduct, accounting irregularities or the inklings of attention from a prosecutor, things usually need to happen fast and thinking time can be scarce. Continue reading “Wrestling with the Data Protection Act 1998”

Insurance law reform: a better world for insureds?

Having reformed insurance law for consumers with a new Act in spring 2012, the Law Commissions have been grappling with changing the law as it affects business insurance.

The principle drivers for reform are, firstly, that insureds say they struggle with fulfilling their obligation to disclose all material information that an insurer requires and, secondly, that the current remedy available to an insurer to avoid an insurance policy for any material non-disclosure is perceived to be outdated, one-sided, draconian and unfair. Continue reading “Insurance law reform: a better world for insureds?”

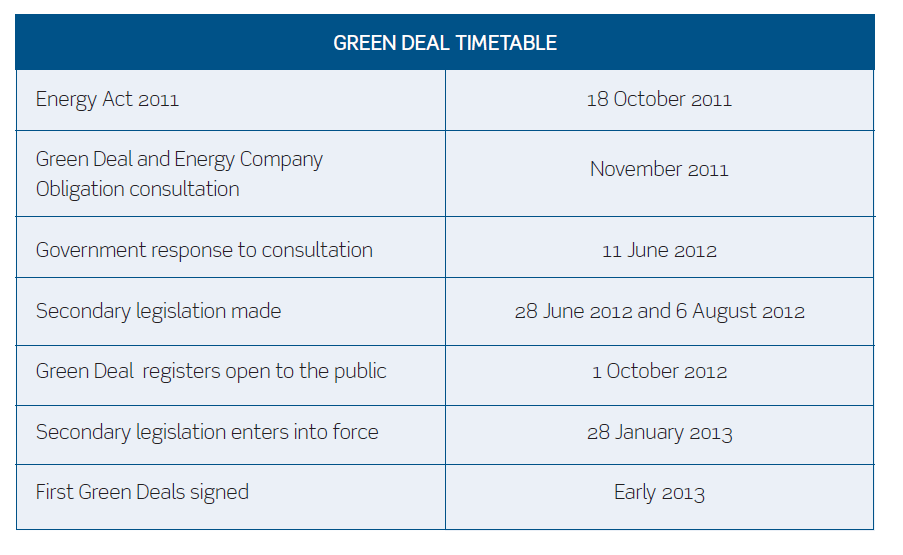

The green deal: legal and commercial issues

This month is expected to see the launch of the coalition’s flagship energy efficiency policy: the Green Deal.

The Green Deal is a policy introduced by the Energy Act 2011 (the 2011 Act) to help fund energy efficiency improvements to existing buildings. The policy has the potential to boost the market for energy efficiency and micro-generation and involve companies and organisations of all sizes, from multinational banks and major retailers to small and medium-sized enterprises (SMEs). Continue reading “The green deal: legal and commercial issues”

Better the devil you know: the incorporation of standard terms

A vast number of transactions are entered into whereby a company’s standard terms will be incorporated into the terms of the agreement. This may take place regardless of whether a party is actually aware of those specific terms.

In the recent case of Allen Fabrications Ltd v ASD Ltd [2012], the High Court considered the incorporation of standard terms and conditions into a contract between two parties. In doing so, it examined the circumstances in which standard terms will form part of the agreement, particularly where they include an overly onerous term. Continue reading “Better the devil you know: the incorporation of standard terms”

E-billing technology: maintaining a cutting edge

In this article, Charlie Morgan, client relations executive of LSG, shares his views on how technology and supporting bill review services are enhancing the performance of corporate legal departments.

He shares his experience and vision of the future in this changing space and outlines the benefits of using a single platform based on the international billing standards of the Legal Electronic Data Exchange Standard (LEDES). Continue reading “E-billing technology: maintaining a cutting edge”

Tide of change in employer and public liability claims in Scotland

Employer and Public Liability claims are top of the agenda for many finance directors. With their impact on insurance premiums, deductibles and absenteeism levels, it is easy to see why. In particular, small and medium-sized businesses can pay a significant percentage of their turnover on employer and public liability insurance, in already straitened times. Continue reading “Tide of change in employer and public liability claims in Scotland”

Risks following a product recall, part 1: disclosure and freedom of information requests

Following a product recall, there are a number of risks to a business that the directors, senior staff and the legal team should be aware of from the outset and may need to address long after the initial recall.

The dissemination of documents created during a product recall poses a real threat to a company and can have serious implications in the event of a potential criminal prosecution. Continue reading “Risks following a product recall, part 1: disclosure and freedom of information requests”

Sins of the father

It is a well-established principle of company law that a company has a separate legal personality from its members (Salomon v A Salomon & Co Ltd [1897]). In certain limited circumstances, such as where the corporate structure has been used for the purposes of a fraud or as a device to avoid an existing contractual or legal obligation, the court will ‘pierce the corporate veil’ but, as a general rule, shareholders will not be liable for a company’s acts or omissions. Continue reading “Sins of the father”

A taste of home: the issue of imitative businesses in the United Arab Emirates

The Gulf region still represents a growing, often untapped, market for international consumer-facing brands. This is particularly true of the most open and accessible of all Gulf markets – the United Arab Emirates (UAE). The UAE occupies a unique position halfway between Asia and the markets of Africa and Europe. In a very short period of time, it has established itself as a major trade, business and financial hub, as well as a major tourism destination. It is the home of two of the world’s fastest growing and most profitable airlines, bringing people into the region from every corner of the world. Estimates put the Emirati population at 10-15% – the remainder being made up of expatriates, both short and long-term residents, from over 190 countries. When tourists/visitors are added to the mix, a unique market demographic is created, in which the awareness of foreign and international brands is particularly high and many consumers are hungry for something familiar from home. Continue reading “A taste of home: the issue of imitative businesses in the United Arab Emirates”

Wrongful trading, the benchmark for directors’ duties: recent developments

The wrongful trading provisions of the Insolvency Act 19861 were introduced following the recession of the early 1980s, having been previewed in the Cork Report. Although new to English law in 1986, the concept of wrongful trading has not resulted in a plethora of cases against directors reaching court. Nevertheless, it remains significantly important, especially in today’s economically challenging environment, as it provides the benchmark against which directors can judge the extent of their duties when their company is in financial difficulties. Many consider it to be slightly odd that more cases have not come to court in the quarter of a century that the law has been in place: we look at the possible reasons for that later in this article. Continue reading “Wrongful trading, the benchmark for directors’ duties: recent developments”

Video conferencing in India

Indian courts in the last decade have been proactive in embracing advancement in technology.

One such pioneering step is the use of video conferencing for recording of evidence. Continue reading “Video conferencing in India”

For better or worse, until UKBA do us part? New immigration rules announced 9 July 2012

As part of the government efforts to reduce net migration to sustainable levels, the UK Border Agency (UKBA) has announced significant changes to the Immigration Rules, which came into force from 9 July 2012.

It is estimated that the new rules will prevent up to 18,500 people annually from coming to join family members in the UK. Continue reading “For better or worse, until UKBA do us part? New immigration rules announced 9 July 2012”