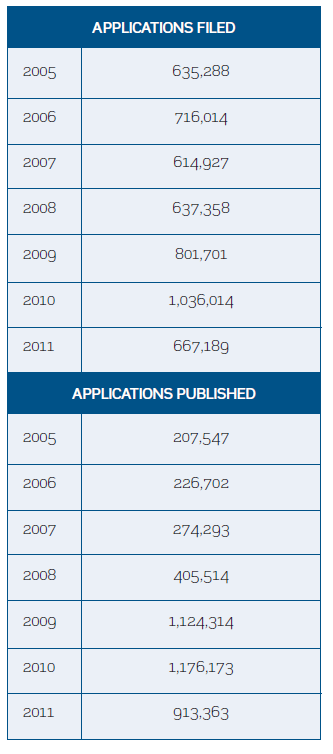

The Indian central bank – the Reserve Bank of India (RBI) – is committed to implementing the Basel III norms in a phased manner in India, commencing from 1 January 2013, with Indian banks being required to comply fully with the new capital adequacy norms by 31 March 2018. Like elsewhere across the globe, banks in India will face several challenges in complying with these new norms, with the principal one being the raising of additional capital. In its annual report published on 23 August 2012, the RBI disclosed its estimate of the additional capital that is likely to be required.

The numbers are staggering – the public sector banks alone would require equity capital of about 1.4-1.5 trillion rupees on top of internal accruals, in addition to 2.65-2.75 trillion rupees in the form of non-equity capital. For major private sector banks the estimated requirement is new equity capital to the tune of 200-250bn rupees on top of internal accruals, in addition to 500-600bn rupees of non-equity capital.

Continue reading “The banking sector

in India: capitalising

on reforms?”