In R (on the application of Prudential plc & anor) (appellants) v Special Commissioner of Income Tax & anor (respondents)[2013], the Supreme Court has held, by a majority of 5:2, that legal advice privilege (LAP) does not apply to communications between a client and an accountant seeking and giving legal advice on tax law. As a result, tax advice, when given by accountants, will not be privileged – even though the same advice would attract legal advice privilege if given by a solicitor. Continue reading “No change: Supreme Court holds that accountants’ tax advice is not protected by privilege”

The European unitary patent: what you really need to know

There has been much hype surrounding the new European unitary patent system and what it means for business. This article aims to explain the new regime in clear terms, setting out the key things you need to know to help your client prepare for the changes. Continue reading “The European unitary patent: what you really need to know”

Freight forwarder’s contractual lien versus the administration moratorium

Our article in The In-House Lawyer’s March 2010 issue (‘The effective use of liens to protect against the collapse of corporate customers’, issue 178, p41-43) dealt with the need for logistics services providers to have an effective contingency plan to cope with the prospect of their retailer customers defaulting on payments or going into administration or liquidation. Following the latest unfortunate round of high-street retailer collapses, including Comet, HMV and Blockbusters, the issues discussed in that article are now just as relevant to freight forwarders, hauliers, shipping lines and other creditors with rights of lien. Since the publication of issue178, a case on general contractual liens has come before the High Court and provides useful confirmation of the rights of holders of a contractual general lien over goods. Continue reading “Freight forwarder’s contractual lien versus the administration moratorium”

Draft guidelines amending the existing regulatory framework for non-banking financial companies in India

The non-banking financial sector in India is regulated by the Reserve Bank of India (RBI). The RBI had set up a working group under the chairmanship of Usha Thorat, to review the regulatory framework for non-banking financial companies (NBFCs). The working group submitted its report in August 2011, suggesting certain amendments to the regulatory framework governing NBFCs. The RBI released the new draft guidelines for NBFCs based on the Usha Thorat Committee report on 12 December 2012 and has sought public comments on them. Continue reading “Draft guidelines amending the existing regulatory framework for non-banking financial companies in India”

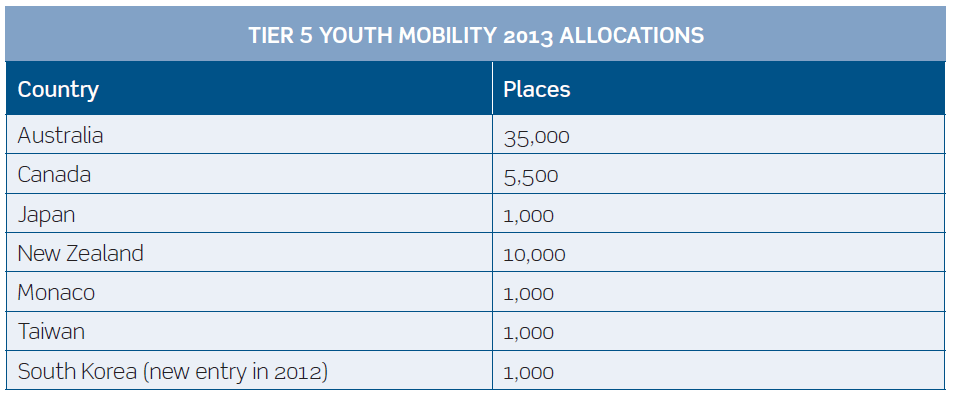

UK immigration: winter 2012-13 update

In November 2012, the government introduced yet more changes to the immigration rules, the majority of which came into force from 13 December 2012. Continue reading “UK immigration: winter 2012-13 update”

UK bids to become the forum of choice for antitrust

The UK Department for Business Innovation & Skills (BIS) has now published the UK government’s response to a consultation regarding private actions for damages arising from infringements of UK competition law. In this publication, Private Actions in Competition Law: a Consultation on Options for Reform: Government Response1, the government has made a number of proposals that will – if enacted – have a significant impact on the way private enforcement of competition law is litigated in the UK. Continue reading “UK bids to become the forum of choice for antitrust”

Knowledge is power: the tension between commercially sensitive material and access to environmental information

It is accepted wisdom that, in the field of the environment, improved access to information and public participation in decision making enhances the quality and the implementation of decisions, contributes to public awareness of environmental issues and gives the public the opportunity to express its concerns and take part in the debate. That wisdom is enshrined in the Aarhus Convention on Access to Information, Public Participation in Decision-Making and Access to Justice in Environmental Matters1 to which both the EU and the UK are signatories. Continue reading “Knowledge is power: the tension between commercially sensitive material and access to environmental information”

How reliable are warranties?

Due diligence risk allocation in share and business purchase agreements has kept the courts busy recently. The commercial approach to interpreting them adopted by the courts in 2012 will please transaction lawyers, but important questions remain unanswered. Continue reading “How reliable are warranties?”

Recovery of tax by lifting the corporate veil

The concept of an incorporated company having a separate existence and the law recognising it as a legal person separate and distinct from its members/shareholders was first recognised in the case of Saloman v Saloman & Co Ltd [1897]. Consequently, the legal framework pertaining to a company’s operations and obligations acknowledges separate legal existence as a key feature of the company structure. Lifting or piercing the veil of corporate personality means that the company is no longer viewed as a distinct entity. On the other hand, the company is seen as being no different from the persons who own the shareholding of the company. Simply stated, by applying the doctrine of ‘piercing the corporate veil’, courts disregard the separate corporate existence of the company and fix liability on the directors or other officers of the company as the case may be. Continue reading “Recovery of tax by lifting the corporate veil”

Further changes from the UK Border Agency

The Immigration Rules are constantly changing and, with a number of amendments made throughout the year, even the UK Border Agency (UKBA) is struggling to keep up. It is important to remember how many people these changes affect – according to the 2011 census almost 8.5m people who live here were not born in England and Wales. Headlined as ‘non-substantive’, the ninth Statement of Changes HC 820 for 2012 came into force on 13 December 2012. Although made generally with clarification in mind, it also includes some new provisions. Continue reading “Further changes from the UK Border Agency”

Consent and connivance: the criminal liability of directors and senior officers

In our November article, ‘Establishing the criminal liability of corporations’, we looked at how liability for criminal offences can attach to corporations, where the commission of the offence is attributable to someone who was at the material time the ‘directing mind and will’ of the company.1 This article looks at the related issue of how criminal liability can attach to individual directors and senior officers as a result of actions taken by those whom they manage. Continue reading “Consent and connivance: the criminal liability of directors and senior officers”

European competition law selected highlights: the last six months of 2012

The last six months of 2012 saw a number of interesting European competition law developments. In this article we summarise those which appear to us to stand out as raising issues of substance or procedure that will affect the application of competition law in the future. In summarising these key developments, we distinguish between developments in relation to non-cartel cases, cartel enforcement and merger control respectively. Continue reading “European competition law selected highlights: the last six months of 2012”