A new offshore transmission licensing regime (the regime) was introduced in 2009 that set out to radically change the way in which offshore transmission assets (ie those assets connecting offshore generating assets to the onshore electricity networks) were designed, built, funded and operated. Three years on, while many of the underlying mechanics of the regime remain broadly unchanged, there have been fundamental shifts in government policy that have led to huge practical changes in the regime’s impact on developers and investors.

This article seeks to provide an updated analysis of the regime, and highlights some of the current issues with which the offshore wind industry is grappling.

BACKGROUND

For many of the early rounds of offshore wind development, the developer was responsible for consenting, licensing, constructing and maintaining all of the grid connection assets, from the turbines to the onshore substation. However, the government considered that this system was incapable of delivering cost-effective and timely connections for this scale of development in a manner that would ensure the integrity of the transmission system as a whole.

The government first began consulting on the design of a new offshore transmission regulatory regime back in 2005. The regime was finally implemented in 2009, using powers afforded to the Secretary of State in the Energy Act 2004, through the enactment of the Electricity (Competitive Tenders for Offshore Transmission Licences) Regulations 2009 (SI 2009/1340) (the Tender Regulations) and through a series of changes to the existing system of licences, codes and agreements that governed onshore electricity transmission.

KEY FEATURES OF THE REGIME

The key principles of the regime are as follows:

- all offshore connections in the Renewable Energy Zone and in the territorial sea adjacent to Great Britain to shore at 132kV or more require an offshore transmission licence to be in place;

- an offshore transmission licence must be obtained through a competitive tender process in accordance with the Tender Regulations;

- the competitive tender process allows companies to bid for a licence to be the Offshore Transmission Network Owner (OFTO) of particular offshore networks, which entitles them to earn a regulated rate of return on the costs of building and operating these networks;

- the generator is not able to be the OFTO, ie there must be separate ownership of generation and transmission assets once projects are operational (with some exceptions).

The regime was designed in two phases: the transitional regime, which applies to those projects that could achieve (or demonstrate that they would achieve) a prescribed stage of development by 31 March 2012, and the enduring regime, which applies to all other projects.

Under the transitional regime, developers construct the necessary transmission assets, with the completed transmission assets being transferred to an OFTO appointed through Ofgem’s1 tender process at a price set by the authority following a costs assessment, based on the costs that ought to have been incurred: therefore, for transitional projects, the role of the OFTO is to finance, own and operate an asset that has been or will be constructed by the developer.

Ofgem has run two tender rounds under the transitional regime, with an amended version of the tender regulations being introduced in 2010 (SI 2010/1903) to reflect lessons learned from the first round. For each tender round, tender rules are published that prescribe the tender process in detail.

The transitional tender rounds have been open to ‘qualifying projects’, that either obtained, or demonstrated to Ofgem that they would obtain by 31 March 2012, the following:

- a grid connection agreement with National Grid Electricity Transmission plc (NGET);

- an agreement for lease of the seabed with The Crown Estate Commissioners (introduced in the 2010 Tender Regulations);

- all necessary consents and property rights for the transmission assets to be constructed and maintained;

- completed construction of, or entry into contracts for the construction of, the transmission assets; and

- financing to construct the transmission assets.

The transitional regime has proven to be fit for purpose. The first transitional tender round commenced on 22 June 2009 and included nine projects2. An additional four projects3 have been included within the second transitional tender round (taking place in two tranches), the first tranche of which commenced on 17 November 2010.

To date, each tender process has attracted sufficient interest from bidders for the process to be regarded as competitive. Licences have already been granted and transmission assets have been transferred to numerous OFTOs under the transitional regime. A feature of the OFTO bidding process has been the formation of consortia to participate in the bidding process, which is unsurprising given the value of the assets being transferred4. This trend will almost certainly continue into the enduring regime.

ENDURING REGIME

When originally designed, it was envisaged that, under the enduring regime, an OFTO would be appointed to design and construct offshore transmission assets as well as financing, operating, maintaining and owning them. By introducing a competitive process into the design and build stage, it was considered that this would encourage innovation and provide scope to attract new sources of technical expertise and finance to the sector, thereby providing best value to consumers.

A significant concern for developers was that this would lead to a loss of control over a critical component of their projects. Developers argued that uncertainties about the identity and capability of the OFTO, the difficulties of dovetailing development timelines and the practical issue of having to incorporate a 12-18 month tender process early on in the project development timetable would, at best, increase the cost of capital through higher risk premiums, and at worst, preclude positive investment decisions entirely. With the delivery of a substantial amount of offshore wind this decade being key to the government meeting its 2020 Renewable Energy Directive targets, the Department of Energy and Climate Change (DECC) and Ofgem revisited the original policy. In August 2010, DECC announced that it was considering the concept of ‘generator-build’ under the enduring regime and on 31 December 2010 changes to the Connection and Use of System Code (CUSC) and the Grid Code took effect, introducing the generator-build option on an enduring basis. Subsequent changes have also been made to the System Operator/Transmission Owner Code (STC) to fully implement the policy.

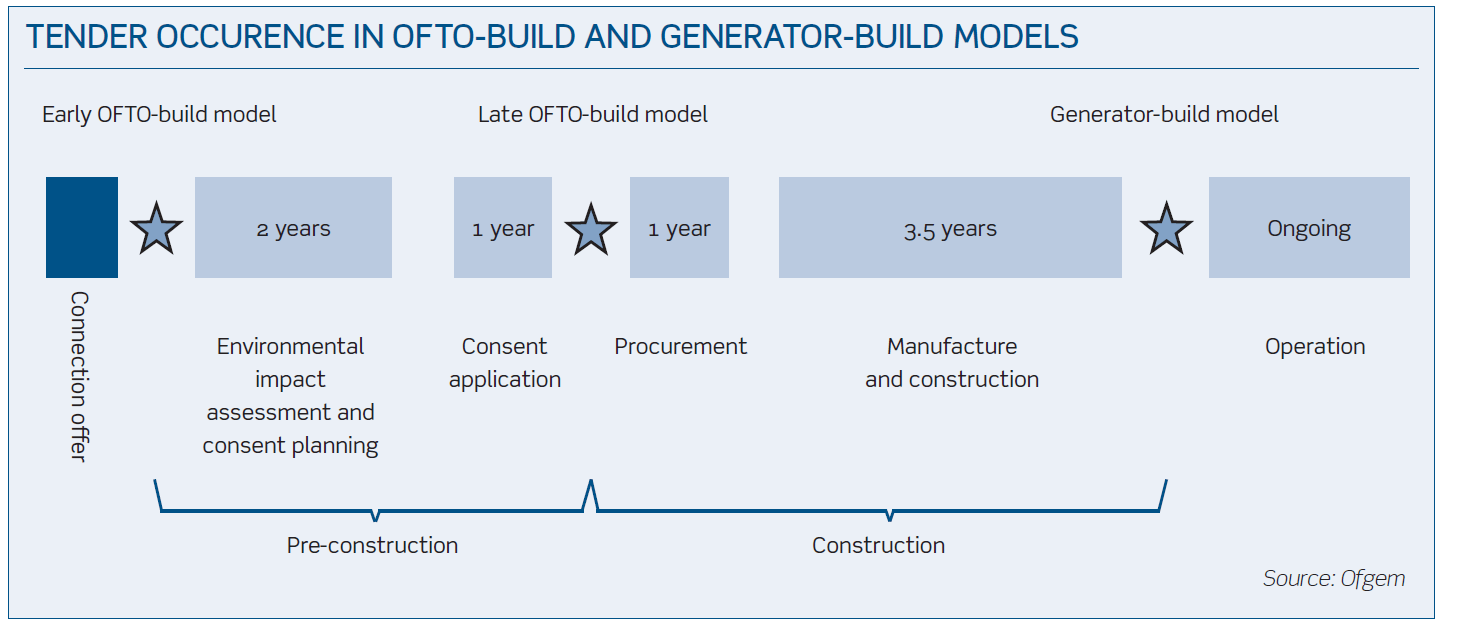

Under the enduring regime, offshore developers will have the flexibility to choose whether they, or an OFTO, design and construct transmission assets. Regardless of the party who constructs the offshore transmission assets, an OFTO will be responsible for their ongoing ownership and operation. DECC and Ofgem are still enthusiastic about the OFTO-build model, and significant attention has been paid in trying to devise a regime that may work for developers. The two main variants are the ‘early OFTO-build’ and ‘late OFTO-build’ models. The diagram below shows where the tender would be likely to occur in each of the OFTO-build and generator-build models.

Under an early OFTO-build model, the OFTO would be responsible for all aspects of pre-construction, consenting, procurement, construction and operation of transmission assets. Under a late OFTO-build model, the OFTO would deliver the procurement of the transmission assets and construction phases of the build programme, after a generator had obtained the necessary consents for the transmission works.

Despite the best efforts of Ofgem to make the OFTO-build model a viable option for generators, and appetite on the part of some prospective OFTOs to take on responsibility for building out the transmission assets, it appears unlikely that many (if any) developers will opt for an OFTO-build approach in the near future. Even though the OFTO-build option reduces the initial capital requirements of the developer, the cost of the transmission assets might typically only equate to 10% of the capital cost of the whole project, and therefore this advantage is perhaps unlikely to outweigh developers’ concerns of potential revenue loss if there was a late delivery of the transmission assets by the OFTO.

THE ENDURING REGIME TENDER PROCESS

On 10 September 2012, Ofgem issued draft replacement Tender Regulations for consultation aimed at ensuring the enduring regime is suitable for future projects5. The first tender round under the enduring regime is expected to commence in summer 2013. Under the 2012 Regulations, the tender process for the enduring regime will comprise the following stages:

- Developer requests Ofgem to commence a tender exercise, specifying whether it will be a generator-build or OFTO-build project and providing evidence that the relevant ‘qualifying project’ requirements (above) have been satisfied.

- Ofgem notifies developer of the fee and the level of security required to be placed to cover Ofgem’s costs of running the tender and the entry conditions that must be satisfied (including the provision of project details for a data room and a draft transfer agreement to be entered into between the developer and the successful bidder).

- Ofgem publishes a notice of its intention to commence a tender exercise for all qualifying projects. Detailed tender rules and the costs recovery methodology detailing the payments to be made by bidders at each stage of the process are published by Ofgem before the commencement of the tender round.

- Pre-qualification stage, to determine the qualifying bidders. Bidders sign a confidentiality agreement and project information is then made available to them by Ofgem.

- Qualification to tender (QTT) stage, to determine the bidders that will be invited to participate in the invitation to tender (ITT) stage. Ofgem has discretion as to whether to hold a QTT stage for transitional or generator-build tender exercises6.

- ITT stage, to determine which qualifying bidders will become the preferred bidder or reserve bidder for each qualifying project. For OFTO-build tenders, the developer may be required to make a payment to cover bidders’ costs if the tender is withdrawn in certain circumstances.

- Best and final offer stage, although Ofgem may dispense with the need for this.

- Preferred bidder stage, in order to determine the successful bidder to whom the transmission licence is to be granted for a qualifying project. Ofgem will publish a notice specifying the identity of the preferred bidder and will inform the preferred bidder of the steps required to be taken for the preferred bidder to become the successful bidder. In practice, this will include the entering into by the preferred bidder of a transmission owner construction agreement with NGET and the accession of the preferred bidder to the STC.

- Developer enters into an agreement transferring the transmission assets (in the case of generator-build) or the preliminary works (in the case of OFTO-build) to the preferred bidder when it becomes the successful bidder. The successful bidder is granted an offshore transmission licence.

KEY ISSUES UNDER THE ENDURING REGIME

Aside from the changes to the Tender Regulations, the sector has been grappling with some significant practical and policy considerations over the last few years. Some of the main issues are highlighted below.

COMMISSIONING

The concept of generator-build has presented a practical issue concerning the commissioning of generating stations. Ofgem recognises that the OFTO will want to see the transmission assets working prior to taking ownership of them. However, s4(1)(b) of the Electricity Act 1989 currently prohibits the transmission of electricity to any premises without a licence at any time, whether before or after the completion of commissioning.

To address this issue, the Energy Bill proposes amendments that would change s4 of the Act to allow a generator to transmit electricity without a transmission licence for up to 12 months from a commissioning completion notice being served, in certain circumstances. The aim of the 12-month grace period is to give time for the OFTO appointment to be finalised post commissioning. When the Energy Bill is enacted, this issue should therefore be resolved.

STAGED AND PHASED PROJECTS

Many round three projects are taking place within large zones, where developers will seek to develop projects on a phased basis. Ofgem has been keen to try to understand how developers will go about structuring the development of these large zones and how investment decisions will be made, so as to develop rules on whether transmission assets should be tendered within the same tender round and, if so, whether these assets should be bid on separately or as part of the same package.

In May 2012 Ofgem consulted on how ‘staged projects’ and ‘phased projects’ should be treated under the enduring regime. The policy position announced in September 2012 was that the scope of a tender exercise would normally be limited to a committed project phase, but that where that committed phase is being built out in more than one stage, all of the stages within that phase should be included within a single tender exercise. Ofgem has stated that it will work with developers to consider variations in a limited number of project-specific circumstances.

CO-ORDINATED NETWORKS AND ANTICIPATORY INVESTMENT

In March 2012 Ofgem and DECC published a joint conclusions report aimed at tackling potential barriers to the co-ordination of offshore transmission assets, citing potential costs savings of £3.5bn by 2030. Ofgem has sought to allow for a more holistic view of long-term network planning across onshore and offshore needs, to avoid a scenario whereby all offshore projects connect to shore via radial links. To help system planning, an amalgamation of the Offshore Development Information Statement and the Seven Year Statement is seen as an important step.

The solution to developing a co-ordinated and efficient network is highly complex, given that the most efficient offshore network would potentially involve the shared use of offshore transmission infrastructure by different offshore developers and the integration of these networks with onshore reinforcements taking place offshore (such as the East Coast and West Coast ‘bootstraps’).

Ofgem is still working on removing the barriers to co-ordinated networks, and seeking to clarify how best to facilitate offshore infrastructure investments that have a wider onshore or offshore system benefit. In doing so, it has identified three main categories of potential anticipatory investment (AI) that may be required.

- Offshore generator focused AI – to support more efficient connections for later phases of generation.

- Wider network benefits AI undertaken by a developer.

- Wider network benefits AI not undertaken by a developer.

NGET has already started to propose integrated solutions in its grid connection offers to developers for phased projects. However, while developers are likely to be in favour of oversizing their transmission assets on the first phase of zone development to facilitate a more efficient connection of additional capacity within their zone at a later date, they will understandably be concerned at the prospect of being asked to carry out transmission works for wider system benefit. Ongoing work is being carried out to identify whether there are appropriate incentives for developers to construct assets providing wider network benefits. It is recognised that the transmission network use of system charging and user commitment methodologies will need to appropriately cater for these arrangements if developers are to be asked to do this.

In instances where the developer is not best placed, or does not have the appetite to develop infrastructure for wider system benefit (for example where the wider benefits are not key to the generation project in development), Ofgem has indicated that it may be appropriate for a separate competitive tender to take place whereby an OFTO would be appointed to construct and own the assets. Ofgem is currently working on providing further clarity as to how AI would be treated when Ofgem assesses the asset transfer value during a tender process. This will be a crucial issue to understand for both developers and prospective OFTOs.

GENERATOR-BUILD CONNECTION AGREEMENTS

Since December 2010, all developers making a connection application at 132kV or above, or already having such connection agreements in place, have been asked to confirm whether they will be pursuing the generator-build or OFTO-build approach. All agreements issued pre-December 2010 were drafted on the basis that an OFTO would construct the assets, therefore most (if not all) of these agreements are in the process of being revised to reflect the generator-build approach. The obligations of developers under these generator-build connection agreements put the developer in a novel position of being a quasi-transmission owner (albeit without being a signatory to the STC), which has created some interesting new practical issues for the developer to manage.

COSTS RECOVERY

Pursuant to the Tender Regulations, Ofgem must assess the economic and efficient costs that ought to have been incurred by the developer in connection with the development and construction of the transmission assets. Under the transitional regime, various reports have now been published on cost recovery issues for individual projects. While certain trends can be identified, Ofgem has recognised that some additional guidance on costs recovery principles would be helpful for developers and a more detailed costs assessment methodology is expected by the end of 2012. It is already clear that in addition to keeping an accurate and full audit of costs incurred, it will also be important for a developer to be able to justify why particular transmission-related decisions have been taken (for example in respect of the acceptance of contractual risks and the settlement of any disputes that arise during the construction process). Ofgem has informally encouraged developers to maintain an open dialogue with regard to keeping them informed of key decisions, to help minimise the risk of Ofgem concluding that decisions made by the developer led to costs being inefficiently incurred.

OFTO SPVS

To date, under the transitional regime, the transfer of transmission assets has taken place through an asset purchase agreement entered into between the developer and the successful bidder. Many developers are exploring the option of setting up a special purpose vehicle to own all of the relevant transmission assets from the outset (an OFTO SPV), which could also enter into all of the relevant contracts relating to those transmission assets. The main perceived advantages are that:

- it may assist with the separation of generation and transmission costs from a costs auditing perspective; and

- it may simplify the asset transfer process by allowing a sale of the shares in the OFTO SPV to the successful bidder.

Ofgem has now allowed for an OFTO SPV approach in the 2012 Tender Regulations but is currently neutral as to which option should be chosen. The decision as to whether to have an OFTO SPV will depend upon the preferred approach to development and procurement adopted by each developer and it is expected that both options will be chosen under round three.

THE THIRD PACKAGE

The third package of legislation on the liberalisation of the internal electricity and gas markets seeks to achieve separation of the ownership and operation of transmission systems from generation and supply activities. This means that generators building transmission assets under the OFTO generator-build option will not be able to own and operate the assets themselves after the assets become operational unless a derogation or exemption applies. DECC will no doubt have been mindful of the requirements of the third package when considering the solution to the commissioning issue highlighted above. OFTOs also need to comply with the third package unbundling requirements and Ofgem has been required to certify each OFTO as being compliant.

CONCLUSION

When introduced in 2009, the new regime was met with significant concern from developers nervous as to whether offshore projects could be delivered under an enduring regime that insisted on an OFTO-build approach. The successful operation of the transitional regime and the emergence of the generator-build option have done much to restore confidence in the enduring regime, although significant issues and uncertainties remain to be resolved, particularly for those projects that are likely to form part of co-ordinated offshore networks. For some projects, the regulatory uncertainty has already had an impact upon project delivery timetables. However, despite the problems being complex, there is optimism that solutions will be found to the outstanding issues and that the enduring regime will be capable of delivering value to consumers, attractive investment opportunities for OFTOs and timely connections for developers.

Notes

- For simplicity, Ofgem is used to refer to Ofgem, Ofgem E-Serve and the Gas and Electricity Markets Authority in this article.

- Robin Rigg, Gunfleet Sands, Sheringham Shoal, Ormonde, Greater Gabbard, Thanet, Walney 1 and Walney 2.

- Lincs, London Array, Gwynt y Mor and West of Duddon Sands.

- The estimated asset transfer value for London Array (the largest of the transitional projects) is £428m.

- The 2010 Tender Regulations will continue to apply to those projects which qualified under the 2010 Tender Regulations and in respect of which Ofgem has issued a notice to all qualifying bidders of the payment they need to make in respect of the ITT stage.

- In the draft 2012 Regulations it is proposed (perhaps confusingly) that all non-OFTO build tenders will be referred to as ‘transitional tenders’ (including generator-build tenders) even though they take place as part of the enduring regime.