This article presents an update on some key areas in chemicals regulation and product stewardship. A central theme is the importance of businesses having reliable control of the information available through their supply chains, without which compliance is much harder to achieve and reputational risks much greater.

CONFLICT MINERALS

On 20 May 2015, the European Parliament voted in favour of strengthening the provisions of a draft Regulation that builds on US efforts to prevent conflict minerals from entering the global market. The draft Regulation imposes tougher surveillance procedures on European companies downstream of the extraction process for imports from conflict zones – including gold, tungsten, tin and tantalum components in products such as mobile phones. The new draft Regulation takes a much more stringent stance than the voluntary system originally proposed. The European Commission estimates that the proposed Regulation will affect 880,000 European companies, the majority small or medium-sized.

If the draft Regulation is passed in its present form, all importers established in the EU that bring certain minerals sourced from ‘conflict-affected and high-risk areas’ into the EU will be required to conduct due diligence on the origin of these minerals, consistent with the OECD Due Diligence Guidance for Responsible Supply Chain of Minerals from Conflict-Affected and High-Risk Areas or an equivalent system. In addition, the majority of smelters and refiners in the EU will be required to undergo independent third-party audit of their due diligence processes.

These companies will then need to disclose the measures they have taken to address risks of conflict minerals entering their supply chains, including products or components that may contain conflict minerals. The hope is that this will be taken into account by consumers in making their purchasing decisions and investors in making their investment choices. It may also help inform NGO actions and campaigns to scrutinise and publicise a company and its sourcing practices, so reputational risk will also be an issue.

Whereas the US Dodd-Frank Act only concerns sourcing from a specific region in Africa, the EU Regulation draft has a much broader geographic scope of ‘conflict-affected and high-risk areas’ anywhere in the world. The aim is to compel companies to engage in responsible sourcing throughout their entire supply chain and not just for certain countries. This implies an increased cost and administrative burden on these companies, and additionally, creates considerable uncertainty for companies in identifying these areas. Better understanding of the supply chain and traceability will be a key to successful compliance.

MODERN SLAVERY ACT 2015

The Modern Slavery Act 2015 primarily addresses slavery, servitude and forced or compulsory labour and human trafficking, and establishes an Anti-Slavery Commission. However, the new legislation has important implications for businesses with overseas production. The UK government announced in July 2015 that businesses with a turnover of £36m or more will have to report on slavery in their supply chains under the new Act. From October, businesses will be required to publish an annual reporting statement, which describes the steps they have taken to ensure that slavery and human trafficking is not taking place in their supply chains, or stating that no steps have been taken.

Similar to the approach of the draft conflict minerals Regulation, the real strength of the legislation is in public disclosure, and the impact of consumer and investor decisions in response to this disclosure.

REACH AND SUBSTANCES OF VERY HIGH CONCERN: APPLIES TO THE ARTICLE OR COMPONENT?

The EU REACH Regulation imposes notification and information obligations on producers and importers of articles where the Substances of Very High Concern (SVHCs) (carcinogens, mutagens, reprotoxins, endocrine disruptors or equivalent) are present in the articles above a concentration of 0.1% weight by weight (w/w).

Since the REACH Regulation came into force in 2007, however, there has been disagreement among member states on whether the 0.1% w/w threshold should apply to the constituent components of an assembled article, or to the assembled article as a whole. The European Commission’s view has been that the 0.1% w/w threshold applies to the assembled article. This view also has the support of the majority of member states (the majority view), and is reflected in current European Chemicals Agency (ECHA) Guidance on Substances in Articles. The guidance, however, expressly notes the dissenting views of Austria, Belgium, Denmark, Germany, Sweden and France.

In a key preliminary opinion delivered in a test case in February 2015 by Advocate General Kokott, the Advocate General delivered a contrary view to current ECHA guidance. If the Court of Justice follows the opinion, then ECHA’s current guidance will require significant amendment and all importers, producers and suppliers of assembled articles will need to reconsider their current supply chain information. They will need to take steps to ensure that they comply with the notification and information obligations for components as well as assembled articles. A more detailed briefing can be found on the Burges Salmon website.

EU COURT RULINGS ON REACH SVHC CANDIDATE LIST

Two rulings from the General Court, which upheld the listing of substances on the REACH Candidate List, raised another avenue of uncertainty for companies dealing with SVHCs. SVHCs listed on the Candidate List trigger information and notification requirements mentioned above, and may be subject to phase out pursuant to the REACH Authorisation regime. SVHCs are defined to include closed categories of very hazardous substances but also an open-ended category of substances ‘of equivalent concern’. Of the 161 substances currently on the Candidate List, only 14 are listed because they are substances of ‘equivalent concern’.

Producers of two respiratory sensitisers contested ECHA’s decision to add them to the Candidate List. In April this year, the General Court ruled that ECHA was entitled to include the two respiratory sensitisers under the category of substances of equivalent concern and that this interpretation was consistent with the REACH Regulation’s objective of a high level of protection of human health and environment. The Court disregarded the fact that there were no actual safety concerns in relation to these two substances as they were mainly used as intermediates or monomers in industrial settings.

ECHA PROPOSES 15 SUBSTANCES FOR AUTHORISATION

In a further development in July 2015, ECHA has recommended that a further 15 Substances of Very High Concern (SVHCs) be added to the REACH Authorisation List. These substances have been prioritised from the Candidate List because of their high volume and widespread uses, and potential threats to human health or the environment or their potential use to replace substances already on the Authorisation List.

In practice, Authorisation sets a sunset date beyond which a substance cannot be used without very detailed, demanding and expensive justification, by means of socio-economic and other studies, and investigation and evidence of there being no valid and safer substitutes for essential continued uses.

REACH 2018 REGISTRATION DEADLINE

The final EU REACH chemicals Regulation deadline for registration is now in prospect.

For those manufacturing, or importing from outside the EU, any chemical substance above one tonne per year, registration requirements may now apply from 31 May 2018, and pre-registration needs to be completed by 31 May 2017.

This last step in the phased introduction of REACH registration requirements to much smaller tonnage bands is likely to have wide impacts, to catch many smaller companies, and to create considerable pressures for larger companies, for example on availability of laboratory capacity for registration work.

ECHA continues to urge companies to prepare for the 2018 registration deadline well in advance.

CLP 2015 DEADLINE 1 JUNE 2015

1 June 2015 was the date by which the EU Classification, Labelling and Packaging (CLP) Regulation became the only legislation applicable to the labelling in the EU of both substances and mixtures.

The Dangerous Substances Directive and the Dangerous Preparations Directive have now been repealed, and replaced by the CLP Regulation, which implements in the EU the Globally Harmonised System (GHS) agreed at UN level.

Businesses should ensure that all Safety Data Sheets now meet the revised requirements and that classification and labelling of their substances are up to date.

BIOCIDAL PRODUCTS REGULATION: 1 SEPTEMBER 2015 DEADLINE

ECHA has been carrying the warning on its website for some months ‘Biocides – 1 September 2015 – Apply now to stay on the market’.

From 1 September 2015, a biocidal product consisting of, or containing or generating, a relevant substance cannot be made available on the EU market if the substance supplier or product supplier is not included in the Article 95 List for the product type or types to which the product belongs.

It would appear from the Article 95 List, which is available on the ECHA website, that the very small number of suppliers listed for some product types suggests that a number of product and substance suppliers may not have taken action in time, and we expect to see considerable disruption to some supply chains as a result.

CONTROL OF MAJOR ACCIDENT HAZARD (COMAH) REGULATIONS 2015

Revised COMAH Regulations implementing the Seveso III Directive and covering control of major accident hazards at chemical and petrochemical sites came into force on 1 June 2015. The revised Regulations reference the CLP Regulation, and have notification requirements for businesses affected that need to be met by 1 June 2016. New public information requirements will also apply to lower tier COMAH sites.

NINE EU SINGLE MARKET DIRECTIVES RE-CAST WITHIN EU NEW LEGISLATIVE FRAMEWORK

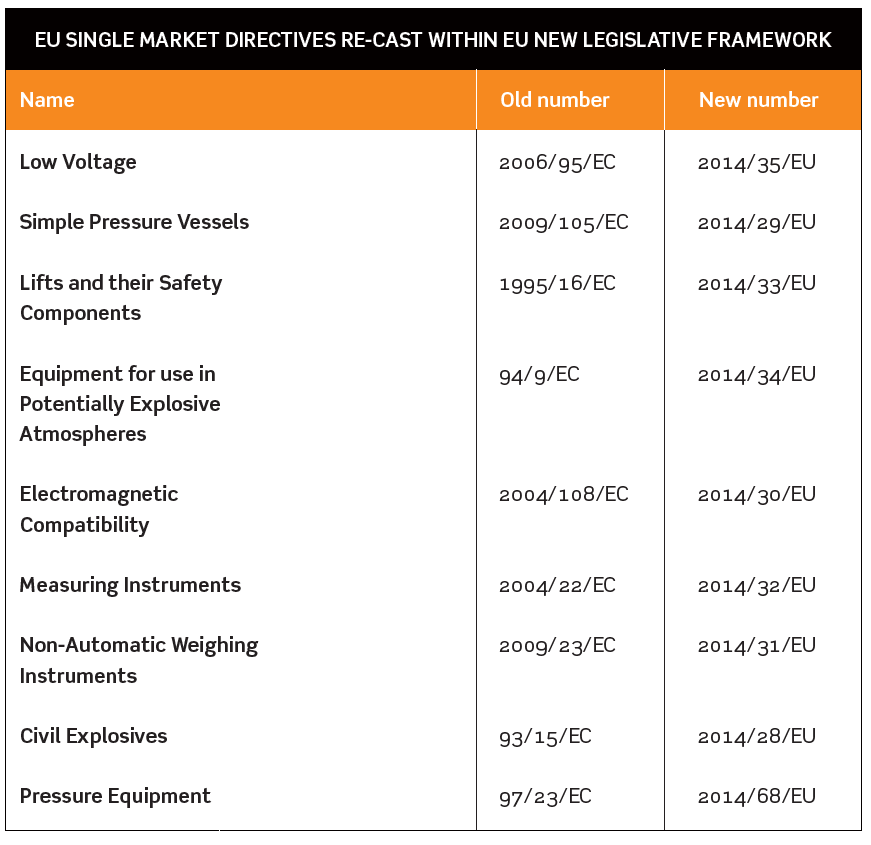

The Department for Business Innovation & Skills (BIS) and Health and Safety Executive (HSE) issued a consultation in August 2015 about the way the government planned to implement EU revisions to nine Single Market Directives. National implementation of these changes needs to be completed by April 2016.

The Directives affected are listed in the table below.

In some cases there will be new obligations on manufacturers, importers and distributors, and detailed provisions about bodies carrying out conformity assessments and market surveillance.

Revised Regulations to implement these changes in EU Directives will result in the replacement of a number of familiar Regulations such as the Measuring Instruments Regulations 2006, the Explosives Regulations 2014 and the Pressure Equipment Regulations 1999. Draft revised Regulations were published as part of the BIS/HSE consultation.

CONCLUSIONS

A common theme running through many of the updates covered by this article is the critical importance of knowing what is in the substances and mixtures at issue, and the way in which they are produced. Businesses which secure information about how their supply chain is made up and the validity of data which is passed up and down the supply chain will be in a much stronger position to deliver compliance with the challenging regulatory provisions that we have described here, and to take advantage of some of the key business opportunities which control of that information can offer.

By Simon Tilling, senior associate, William Wilson, barrister, and Alice Yan, solicitor, Burges Salmon LLP.

E-mail: simon.tilling@burges-salmon.com; william.wilson@burges-salmon.com; alice.yan@burges-salmon.com.