In April 2010 we considered the then proposed Renewable Heat Incentive (RHI) (The In-House Lawyer 179, page 7). Two years on, the RHI is in force and in this article we look at where the RHI has got to and consider some of the practical, commercial and legal issues around the RHI scheme and heat supply contracts.

The 2009 Renewable Energy Directive (RED) set a binding target for 20% of the EU’s energy consumption to come from renewable sources by 2020. As part of this, the UK is committed to generating 15% of its energy from renewable sources by 2020.

Heating accounts for nearly half of UK final energy consumption and carbon emissions. Currently only 1.5% of heating comes from renewable sources. The proportion of heat produced from low-carbon renewable technologies will have to increase substantially if the government is to meet its RED target, as well as its commitment under the Climate Change Act 2008 to reduce carbon emissions by 80% by 2050.

The government hopes that the RHI (which promotes the generation of renewable heat delivered in liquid or steam form) will help drive a significant increase in renewable heat generation. The ambition is that by 2020, 12% of heating can come from renewable sources.

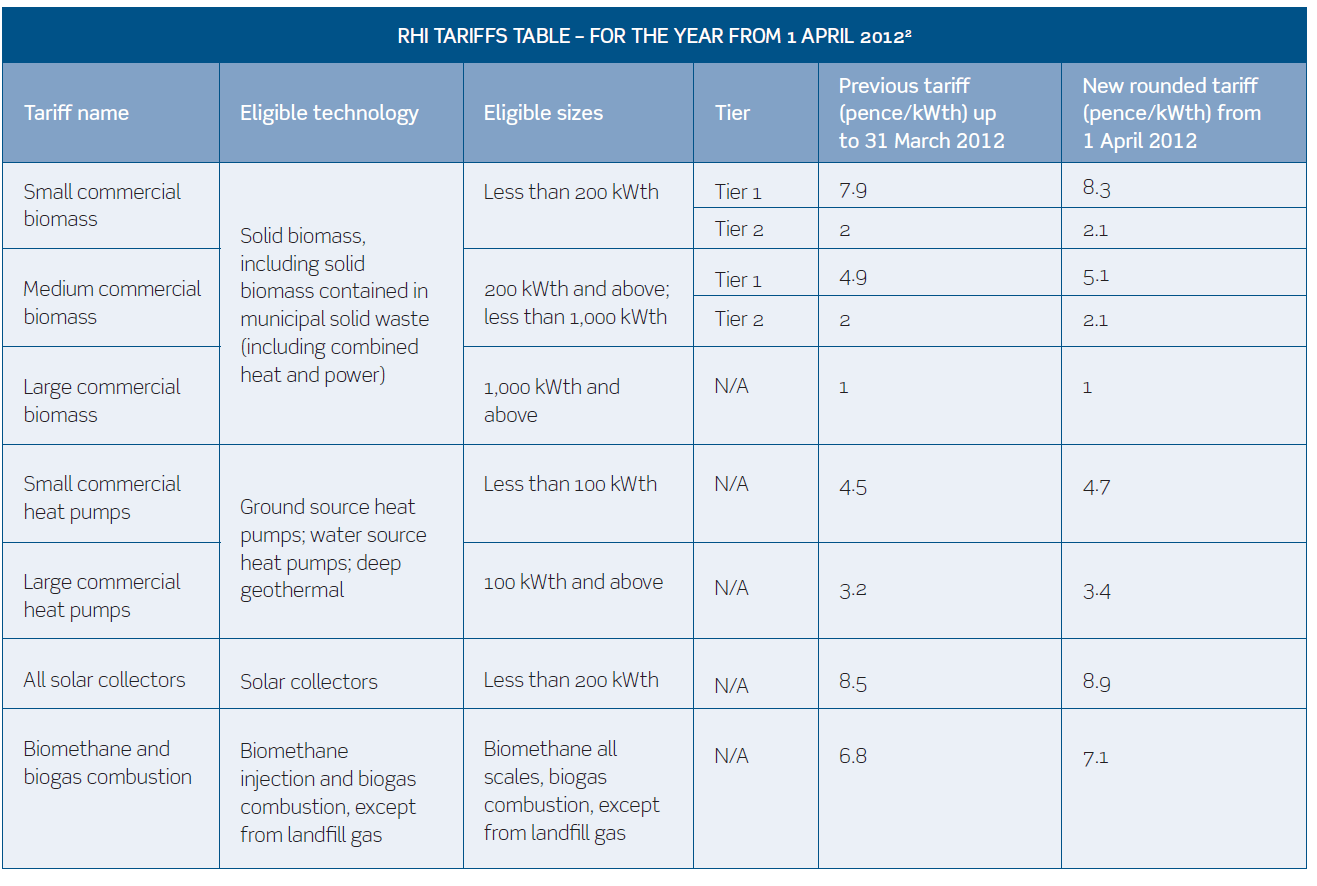

The key principle of the RHI is the provision of a 20-year income stream to any organisation that installs an eligible renewable heating system. Similar to the Feed-In Tariff (FIT) scheme, the RHI sets certain tariffs for different types and sizes of installation (see tariff table).

As of 31 March 2012, 376 RHI applications had been made and 13 RHI installations accredited in England, with a further six in Scotland and one in Wales1.

HEAT PROJECT RISKS

Central to any RHI project, whether funded on or off balance sheet, is the management of project risk. Of particular significance are those risks that are difficult to manage and that collectively could restrict the ability of the project to realise RHI payments and other revenues and savings needed to repay (or justify) investment in the project.

Ultimately, if the contractual arrangements or the regulations surrounding RHI create too much uncertainty, then investors will view these revenue streams as being too risky or unpredictable to commit funds to such projects.

This could mean that a project that is capable of generating RHI eligible heat energy would have to show that it could generate sufficient cash flows or savings from other sources to justify investment. It seems clear that the creation of a stable ‘bankable’ revenue stream was the government’s intention in creating a 20-year, government-underwritten renewable heat tariff in the form of the RHI. This is a subsidy that is clearly intended to appeal to investors as a secure and stable revenue stream.

Accreditation/preliminary accreditation

The fact that there is a preliminary accreditation process for complex RHI projects is a benefit. This mirrors the position under the Renewables Obligation (RO). Preliminary accreditation gives certainty to stakeholders that, before significant amounts of money are committed, Ofgem has confirmed that, on paper, the project will be eligible to receive RHI support. In theory, preliminary accreditation should also make the subsequent accreditation process more straightforward.

However, an issue concerning the industry (both government and developers) is whether, notwithstanding preliminary accreditation, there will be enough money left in the RHI budget for the project once it has been built and accredited. This is because (other than for biogas direct injection projects, where there is a potential loophole) there is no way to ‘secure’ an RHI tariff in advance of the facility being constructed.

Legislative change

As we have seen with the FIT and with the first introduction of banding for the RO a few years ago, changes to the regulatory framework can seriously affect investor and developer confidence in the renewables sector.

On 26 March, only four months after the RHI went live, the government launched a consultation on interim cost control measures that would allow it to suspend the RHI in any given year until the following financial year if estimated spending reached a level where the set budgets could be breached. The experience with the FIT and the dash for solar has been cited as one of the reasons for this change. The consultation also trails a possible longer-term cost control measure, to be consulted on during summer 2012, to allow for degression of RHI tariffs where uptake reaches a certain level.

RHI revenues and assignability

A key feature of RHI payments is that they are only paid to the owner of the accredited installation. This is different from the position under the FIT, where a third-party recipient can be nominated to receive directly an installation’s FIT generation tariff payments. The fact that there is no such nominated recipient process under the RHI has been criticised as a ‘bankability’ issue.

Concerns are linked to the fact that normally a funder would expect to take an assignment of key revenue streams if the heat generator was in default. For RHI revenues, this sort of mechanism will not be available. Although contractual controls can be imposed, these do not give the same degree of certainty and control over the revenue stream.

Financial covenant of heat offtaker

The strength of the heat offtaker’s balance sheet will be scrutinised by investors if RHI payments and heat sale revenues are to be bankable. Future heat revenues are only as good as the heat offtaker is creditworthy. While connection to a heat grid with many customers may dilute the impact of any one customer failing, with a dedicated plant there is no ‘safety in numbers’, so a key piece of the jigsaw is the financial strength of the heat offtaker.

With electricity generation projects, by and large, if there is a suitable grid connection it will be possible to replace an electricity offtaker. With renewable heat, there may be extremely limited circumstances in which the heat generator will be able to find an alternative heat offtaker if the original customer fails. While an actionable breach of contract may exist, it may be of little use if the heat generator is left as an unsecured creditor. Such an eventuality could cause serious difficulties for the project. These risks can be mitigated using a number of contractual devices and potentially some form of credit support, but such requirements add to the overall cost of the project and may make the prospect of switching to renewable heat less attractive to the heat offtaker.

Transition

The impact on a business of switching from dependence on fossil fuel to renewable heat should not be underestimated. Existing energy contracts may need to be renegotiated or relet to reflect a revised fossil fuel consumption profile and infrastructure may need to be updated or decommissioned. In addition, decision makers will need to be convinced that the renewable heat project is deliverable and key elements are either in place or a process for delivery is identified, if management time is to be spent on the project development and transition arrangements. This is the case whether the project is for a ‘self-supply’ or third-party developer supply.

Such key project elements may include:

- a reliable and secure fuel source;

- a deliverable site (exclusivity at least, if not under option);

- a deliverable technology;

- a planning permission or evidence of favourable pre-application discussions; and

- at least an outline pricing structure that is acceptable to the heat generator and the heat offtaker.

Timing

Where heat revenues are an important part of the investment decision, consideration needs to be given about how and when the heat energy contract is finalised. It can be easy for the balance of power in heat supply negotiations to shift away from the heat generator if negotiations are left too late – for example, if planning has already been secured and significant investment has been made in developing the project before there is certainty over the terms of the heat supply contract, the heat offtaker may be able to exert greater influence over key terms.

Conversely, if not enough work has been done to develop the project it may be difficult to get the heat offtaker to engage.

As the heat energy contract may be signed well in advance of any other project documents, there will need to be a robust mechanism to trigger the obligation to supply and purchase the heat energy. The heat generator is likely to want the trigger events to be within its control so that it can manage delays – for example, delays in obtaining a satisfactory planning consent, in securing and finalising the terms of the funding, and to the actual construction of the facility.

The heat offtaker will want some degree of certainty as to the start date of the heat supply so that any migration from fossil fuel dependency to renewable heat can be managed without unduly interfering with its business.

Whether or not there are liquidated damages to compensate the heat offtaker for losses it suffers for a delayed commencement of heat energy delivery will be up for negotiation as part of the commercial deal struck between the parties.

As to when this deal needs to be struck – this will depend on the dynamics of the particular project. For larger projects and/or where there is scope for alternative heat offtakers, a heat generator may wish to be well on the way to having certainty over its heat supply arrangements before submitting a planning application.

Pricing

There are many factors that can be considered in building up a pricing mechanism for a heat energy supply contract. Some agreements opt for a simple pence per kWh of heat supplied, in the same way that the RHI does. In setting the price, the heat generator may also wish to consider the costs the heat offtaker will avoid by receiving renewable heat, such as avoided fossil fuel taxation and supply cost savings.

The pricing mechanism may need to consider issues such as liabilities in the event of an outage at the heat generating facility, which may include additional fossil fuel usage and the operation of standby boilers. Conversely, if the heat offtaker is unable to accept the heat, the consequent risks will need to be managed. For example:

- Can the plant instead generate more electricity to mitigate any downside (such as lost RHI revenues)?

- Is there sufficient capacity in the grid connection agreement to allow export of additional generation?

- Does the power purchase agreement allow additional generation and how does this interact with the notification/forecasting requirements?

- How is the export of additional electricity priced under the power purchase agreement?

Access

It is vital that suitable access rights are granted to the heat generator by the heat offtaker. These may include rights for:

- installation of meters and equipment and break-in to the heat offtaker’s steam main;

- maintenance of equipment where responsibility for the installed plant doesn’t pass to the heat offtaker;

- decommissioning of installed equipment/pipework on termination or expiry of the heat energy contract; and

- the reading of meters located on the heat offtaker’s premises.

The RHI Regulations also impose some specific requirements and failure to comply can lead to sanctions that include reduction or removal of RHI payments. The key provision is Regulation 50 of the RHI Regulations, which gives Ofgem the right to inspect an accredited RHI installation and its associated infrastructure to4:

- verify that the participant is complying with all applicable on-going obligations;

- verify meter readings;

- take samples and remove them from the premises for analysis;

- take photographs, measurements, or video or audio recordings; and

- ensure that there is no other contravention of the Regulations.

Many of these access rights may require access to the heat offtaker’s premises and it is easy to imagine that there could be particular sensitivity around the taking of photos/videos at some premises, so care needs to be taken that appropriate contractual rights are in place.

In addition, Schedule 1 of the RHI Regulations sets out various operational data that needs to be made available to Ofgem in order to gain and maintain RHI accreditation and receive RHI payments5. Again, some of this will require access to the heat offtaker’s processes and premises. The heat generator needs to ensure that it has the right to both obtain and disclose this information in order to comply with its obligations under the RHI Regulations.

Change in law

With all infrastructure projects, changes in law create risks that need to be managed and may involve additional expense or loss of predicted revenues. In the renewable energy sector the rate of regulatory change has created added uncertainty.

Given the size of investment that can be required, heat energy contracts can be long-term contracts that are intended to provide a degree of price certainty for both parties. They may also be for a significantly longer term than the fossil fuel contracts that they replace.

Changes in law that create additional costs/reduce revenues can upset the economics of a project. For the heat generator, the ideal position would be that changes in law that affect the cost of generating and supplying the heat or reduce revenues are picked up by the heat offtaker in the same way that such costs are reflected in fossil fuel prices when supply contracts are negotiated. The heat offtaker, however, will wish to see the heat generator taking its share of risk. A common position in energy contracts is for general changes in law (ie changes in law affecting everyone in business) to be a risk for the heat generator, and this can be offset by indexing prices appropriately. However, changes in law specifically affecting the renewables industry may need to be the subject of a mechanism that can ultimately lead to a variation to the heat supply contract.

While a change in law can certainly be a contentious issue, a sensible change in law regime allows pragmatic solutions to be negotiated to allow the projects to continue, and allows the parties to work out a solution at the time, or have one imposed on them by an independent expert.

At Burges Salmon we are seeing significant interest in the RHI and we are advising on a number of renewables projects whose revenue streams will include heat and RHI payments. These larger projects have a relatively long lead time so their impact is not yet visible in the RHI statistics issued by the Department of Energy & Climate Change. Confidence in the RHI is still tempered by a degree of uncertainty over the regulatory framework and, as is often the case with renewables, only time will tell whether investor confidence is sufficient to enable the government to deliver its policy objectives for renewable heat.

By Nick Churchward and James Phillips, senior associates, Burges Salmon LLP.

E-mail: nick.churchward@burges-salmon.com; james.phillips@burges-salmon.com.

Main features of the RHI

- The RHI applies in England, Wales and Scotland and is the first scheme of its kind in the world.

- It is implemented by the Renewable Heat Incentive Scheme Regulations 2011 (SI 2011/2860) (the RHI Regulations).

- Phase 1 of the RHI is aimed at the non-domestic sector, which contributes 38% of the UK’s carbon emissions and opened for applications on 28 November 2011.

- Phase 2 is yet to be implemented and will primarily cover domestic installations.

- Heat must be delivered in the medium of liquid or steam.

- Heat must be used for an eligible purpose, ie heating space, heating water or carrying out a process, and in each case in a building.

- RHI payments come from direct taxation (unlike the RO or FIT) and the budget for the spending period ending in 2014/15 is fixed at £864m.

- Initial uptake has been slow, with only £115,500 of RHI payments made by 16 May 20123.