The current reforms of the electricity market are intended to help tackle the ‘energy trilemma’: how to decarbonise electricity supply while ensuring security of supply and keeping prices affordable for consumers. The Capacity Market is one of the central pillars of the UK’s electricity market reform proposals and is aimed primarily at ensuring security of our electricity supply.

As a result of the increasing amount of intermittent generation expected to be added to the UK’s electricity mix over the coming decade and the anticipated increase in the electrification of our energy-consuming infrastructure (such as electric vehicles), the Capacity Market is intended to ensure sufficient investment in the overall level of reliable capacity needed to meet the UK’s future electricity needs.

The principles behind the Capacity Market were first published in the energy white paper back in July 2011. Further details have been fleshed out between June and December 2013 through a series of detailed design proposals, consultations and the EMR Delivery Plan which was published by the Department of Energy & Climate Change (DECC) on 19 December 2013.

This article examines the key features of the Capacity Market and highlights some of the challenges that will be faced by those looking to exploit the opportunities it creates.

THE CAPACITY MARKET AT A GLANCE

The Capacity Market is designed to ensure sufficient investment in the reliable capacity needed to ensure security of supply during prolonged periods. It will do this by providing certain, regular payments to capacity providers, in return for which they must be available and producing energy (or reducing demand) when the system is tight, or face penalties.

The Capacity Market will operate alongside the electricity market – which is where most participants will continue to earn the majority of their revenues. There will also remain a need for National Grid to contract short-term balancing services to ensure the moment-to-moment balancing of the system.

SECURING CAPACITY

The amount of capacity contracted each year will be based on an enduring reliability standard, which will specify an indication of the acceptable level of security of supply for the GB system. This is expressed as a loss of load expectation (LOLE), ie the number of hours per annum in which it is statistically expected that supply will not meet demand. The government has decided that a LOLE of three hours per annum is acceptable.

Importantly, the government is not stating that this level of capacity will be secured at any cost. Built into the system will be demand curves and an ultimate auction price cap which will allow a trade off to be made between reliability and cost. For example, if 50 gigawatts is the ideal amount of capacity but the 50th gigawatt is disproportionately expensive to procure, the system will give scope for only 49 gigawatts to be secured. It is hoped that this will help to avoid prices being pushed artificially high through gaming and/or abuses of market power.

In setting the standard on an enduring basis (subject to review if necessary) the government is seeking to minimise the risk of there being large swings in the amount of capacity auctioned from year to year, to provide investor certainty, which in turn it is hoped will minimise the risk premium built into bids.

The intention is for an auction to be held for pre-qualified capacity every year, for delivery in four years’ time. A year-ahead auction will also be held. Each demand curve (to be published around six months before the respective auctions take place) is based around a target capacity level and an estimate of the reasonable cost of new capacity (referred to as the net cost of new entry, or ‘net-CONE’). The target capacity level will depend upon National Grid’s assessment of the amount of capacity likely to be required to meet the reliability standard, which will of course depend upon the quantity and type of generation expected to be available outside of the Capacity Market.

A lot of detail regarding the basis for calculating net-CONE has been published, although conclusions are still awaited. What does seem clear is that the government intends to retain the flexibility to learn lessons from the first auction. Given the importance of the first auction process being seen to encourage investment, it is perhaps to be expected that the government will err on the side of caution in making sure that the estimates of net-CONE and the auction price cap are not set too low.

THE ELIGIBILITY REQUIREMENTS

The table below summarises which projects will be eligible.

Participation in the Capacity Market will be voluntary, however, in order to inform National Grid as to how much capacity is expected to be operating during each year outside of the Capacity Market, all licensed generators (ie those holding a generation licence) must either apply to pre-qualify, or if they do not wish to bid, submit an opt-out notification and specify whether they intend to run the plant during the year.

The Capacity Market has been designed to be technology-neutral, therefore plants are only expected to be compared on the level of their bids rather than their plant characteristics. One could argue that an opportunity has been missed here for DECC to factor in emissions as part of its assessment of bids for proposed new generation capacity – a sign perhaps that more importance is currently attached to security of supply and affordability than decarbonisation in the eyes of the government. Clearly some installations are more efficient (from an emissions perspective) at operating during start-up and shut-down periods than others, but this is not currently taken into account when auction bids are assessed.

As indicated in the table below, the auction is not restricted to generation and demand side response (DSR) (ie reductions in electricity demand) and all forms of electricity storage will also be entitled to participate.

There will be a pre-qualification stage around four months ahead of the auction, which will confirm the eligibility and bidding status of all potential capacity. There are different pre-qualification criteria depending upon whether the applicant is an existing plant, an existing plant seeking support for refurbishment, a potential new plant or a DSR provider.

For new build plants to pre-qualify, it is proposed that they will need to submit all relevant planning consents, a milestone plan detailing when construction and energisation will be achieved and a valid connection agreement (or confirmation that a connection agreement will be obtained).

Prospective new plants will also need to provide collateral representing 100% of the level of the termination fee that would apply if they failed to satisfy the ‘substantial financial commitment’ milestone within 12 months following the auction. An example of the level of the potential termination fee has been given as c£7.5m for a new plant with a 520MW capacity obligation. A higher termination fee will potentially apply where a new plant fails to have at least 50% of the amount specified in its capacity agreement operational within 18 months of the start of its first delivery year. This higher fee will reflect the increased security of supply risks resulting from the delay.

THE AUCTION PROCESS

For each delivery year, an auction will be held four years ahead of delivery, supplemented by a further auction one year ahead of delivery to enable the participation of DSR and provide an opportunity to refine the level of capacity for which capacity agreements are issued. National Grid will have the capability to run zonal auctions, if necessary, to manage constraints, but no such zones will be created unless approved by Ofgem.

The auction will be ‘pay as clear’. This means that all participants will receive the clearing price set by the marginal bidder. It will follow a descending clock format, in which the price offered is gradually reduced until the minimum price is reached, at which the supply of capacity offered by bidders is equal to the volume of capacity required.

On a first glance, it may seem questionable value to be rewarding some capacity providers with a price which exceeds what they would be prepared to accept. However, the government is persuaded that this will avoid the risks of participants ‘gaming’ the system by bidding based on a guess of what the clearing price might be, rather than true costs – noting also that big portfolio players would be better equipped to do this, potentially harming competition. The government is also convinced that existing plants should be compensated on the same terms as new plants, on the assumption that a Capacity Market will dampen wholesale electricity prices – which are currently the means by which all capacity is rewarded. It is also felt that a pay as clear auction will cause the market as a whole to become more efficient by allowing the most operationally efficient plant to earn the highest margins.

To mitigate market power, bidders will be classified as either ‘price takers’ (who cannot bid above a relatively low threshold) or ‘price makers’ (who can). It is expected that most bidders will default to being price takers. New entrants and DSR resources will be classified as price makers, and will be free to bid up to the overall auction price cap (which as described above is likely to be set at a multiple of the cost of new entry).

Existing plants will be entitled to bid for one year capacity agreements unless they require major refurbishment, in which case they may be eligible to access a capacity agreement with a term of up to three years in each round of the auction. New entrants will have access to a longer-term agreement for a term they nominate, up to a maximum limit. Currently, that maximum limit has been proposed at 10 years, although the government is consulting on whether longer-term contracts are required to encourage new investment.

National Grid will run the first auction in November 2014 for delivery of capacity from the winter of 2018/19, subject to state aid clearance. Plants will bid for capacity based on their de-rated capacity (calculated by National Grid based on a published methodology) rather than their ‘nameplate’ capacity.

TRADING CAPACITY

With some restrictions, and only once such trades have been approved by National Grid, capacity providers will be permitted to pass their obligations on to other parties provided the recipient party participated in a previous auction and is not already encumbered by pre-existing obligations. Such trading of obligations will be permitted from a year ahead of the start of the delivery year and throughout the delivery year. Any pre-existing penalties will remain with the party which incurred them.

At any time, parties will be free to hedge their position financially through private markets and it is expected that financial players will also be able to trade freely in this market, increasing market liquidity.

THE OBLIGATIONS

Capacity agreements oblige participants to deliver a specified quantity of electricity in system stress periods notified by National Grid. If a stress period warning notice is shorter than four hours, a plant is only penalised if it provides less capacity than the position it notified under its balancing mechanism physical notification.

Where more than four hours’ notice is provided by National Grid, each provider will be required to generate electricity (or reduce demand) in the quantity required. So, if 80% of all the contracted capacity were required to meet system demand, each provider would be obliged to generate electricity or reduce demand at 80% of its own capacity obligation.

Once a warning has been issued, providers that do not deliver sufficient energy at the relevant time(s) of stress to meet their obligation will be required to pay a financial penalty. No penalties will be applicable for stress periods where no advance warning was provided by National Grid.

Penalties are proposed to be calculated based in part on the value of lost load (VoLL) – a theoretical value intended to be reflective of the amount customers would be prepared to pay to avoid a blackout. To ensure that penalties are not so high so as to prohibit investment, it is currently proposed that each unit’s penalty exposure will be capped at somewhere between 101% and 150% of the unit’s annual capacity revenue. ‘Soft caps’ are intended to be used to ensure that poorly performing participants remain incentivised to perform even once liability caps are reached – ie there will be an opportunity for penalties to be mitigated through subsequent compliance.

Providers that deliver more than their obligation at times of stress may have the potential to earn amounts for over-delivery. Such payments would be calculated by dividing the amount of any penalty payments received in that period by the amount of over-delivered energy in the same period, subject to a cap at the prevailing penalty rate. If there were no penalty payments received in that period, no payments for over-delivery would be made.

National Grid will have the ability to spot test providers where they have failed to demonstrate their ability to deliver the level of capacity specified in their capacity agreement. Capacity payments will be forfeited by any plant which fails a spot test until the plant passes a subsequent test.

MEETING THE COSTS OF THE SCHEME

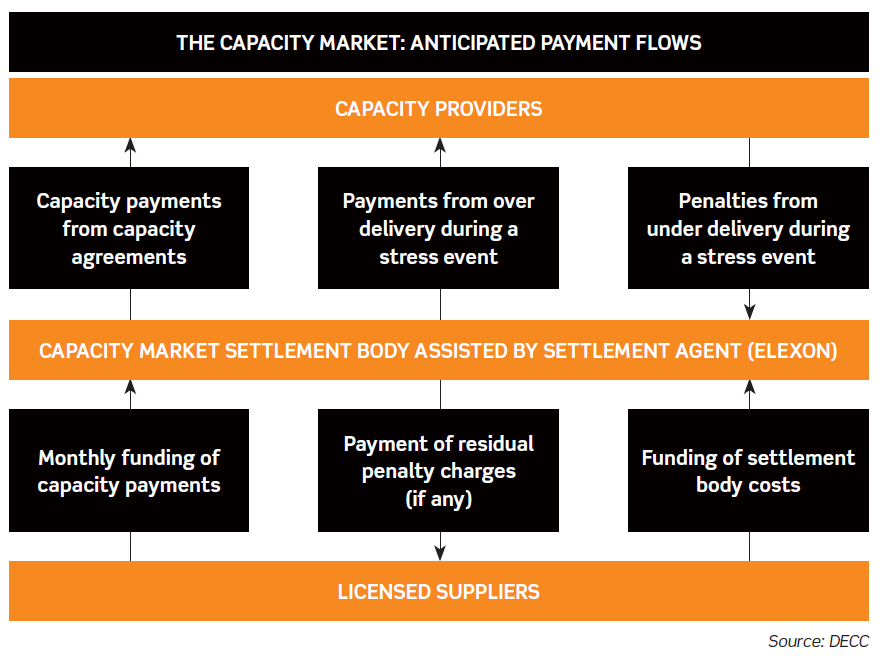

Capacity providers that are successful in the auction will receive capacity payments in the relevant delivery year. They will be funded by a compulsory payment levied on all licensed suppliers based on the suppliers’ share of the market at times of peak demand (anticipated and then reconciled when data becomes available).

The payment flows, including penalties and over-performance payments, will be administered by Elexon, acting as settlement agent. This is an obvious solution given that many of the calculations that will need to be made to calculate performance, payments and penalties will heavily depend on data deriving from the balancing and settlement process which is already managed by Elexon. Certain primary functions, such as resolving disputes, credit management and the provision of banking facilities, will be reserved for the settlement body, which is anticipated to be a new private limited company established and wholly owned by the secretary of state.

The DECC diagram below shows the main anticipated payment flows.

THE PROCESS FOR IMPLEMENTATION

The Energy Act 2013 includes powers for the secretary of state to introduce the Capacity Market. In addition to consequential amendments to the existing electricity industry codes and licences, the Capacity Mechanism will be introduced through a combination of the Electricity Capacity Regulations, Electricity Capacity (Payment) Regulations, and detailed Capacity Market Rules.

The regulations and payment regulations, which will be made and overseen by the secretary of state, include aspects covering the amount of capacity to auction, eligibility criteria and settlement of payments. The rules, which will be made by the secretary of state and then overseen and owned by Ofgem, include technical rules and procedures as to how the Capacity Market will operate, covering pre-qualification, the capacity auction process and penalties.

CONCLUSIONS

Despite the government’s suggestion that all plants beginning construction after May 2012 would be eligible to participate in the Capacity Market, the very publication of a proposed Capacity Market may have contributed to the recent hiatus in investment in new thermal generation, with developers waiting to see the full proposals before making investment decisions. It is very difficult to say whether the market would have delivered the requisite amount of capacity without the Capacity Market intervention. Ultimately, the government has not been prepared to take that gamble.

While many commentators remain to be convinced that the Capacity Market will deliver security of supply in the most cost-effective manner, it is inevitable that the opportunities it creates will be game changing for many proposed new thermal electricity projects as well as potential DSR providers.

James Phillips, partner, Burges Salmon LLP.

E-mail: james.phillips@burges-salmon.com.