‘There is a real mismatch in how gloomy the economy feels and how busy the legal professional feels,’ observes Deborah Finkler, Slaughter and May’s managing partner. ‘We’re incredibly busy and it wouldn’t surprise me that in the similar conversations you’re having with other managing partners, they will say the same. Th ere is just a lot of work.’

When our 2021 Legal Business 100 (LB100) report was published, the profession was riding high on the back of booming deal flow that saw profits and revenues surge to previously unmatched levels. Fast forward 12 months, and the economic outlook is very different. Spiralling inflation, interest rate hikes and the macroeconomic issues resulting from Russia’s continued invasion of Ukraine have made discussions of ‘softening in the market’ commonplace.

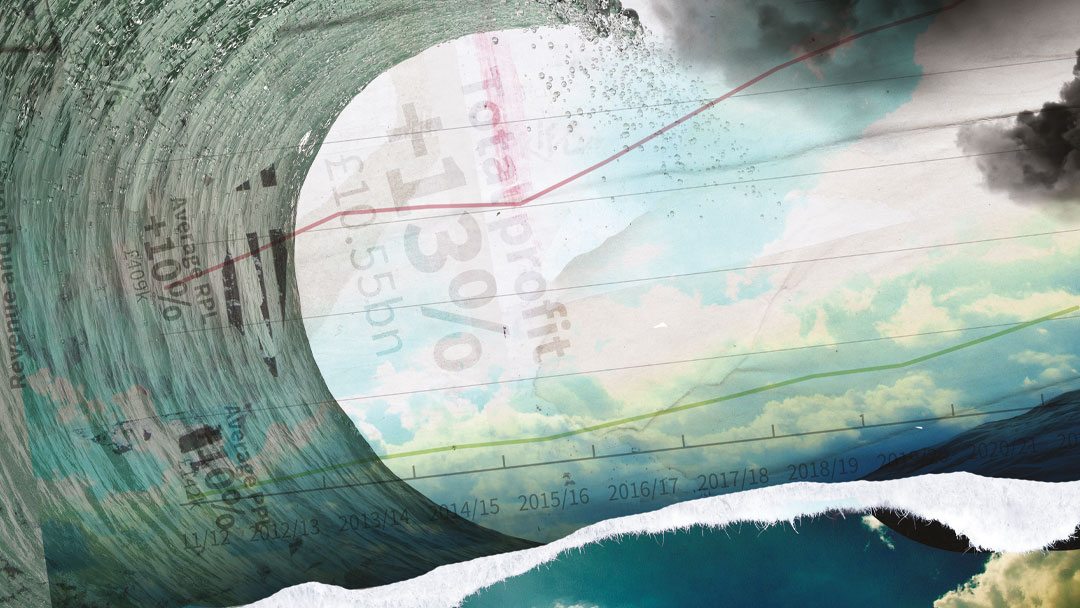

And yet, analysis of the LB100 table betrays little of the turbulence many believe to lie ahead. Despite the overall number of lawyers staying static, revenue across the group grew 9% to £31.35bn, while profit jumped 13% to £10.55bn. Revenue per lawyer (RPL) hit £409,000 after a 10% increase, while profit per lawyer (PPL) grew 12% to hit £144,000. Solid numbers, almost matching last year’s figures, which saw RPL and PPL bolstered by 11% and 12% respectively.

Cream of the crop

Little has changed at the top of the table. Th e Magic Circle firms enjoyed a steady year, with revenue rising between 5% and 10% for the group. Perennial frontrunner DLA Piper also performed well, evidenced by a 35% ballooning in profit per equity partner (PEP) to £1.612m.

The movements of Allen & Overy (A&O) and Hogan Lovells, which swapped positions to now sit in third and fourth place respectively, were the only points of difference from last year’s top ten.

A&O’s ascent to the bronze medal position can be attributed to a 10% addition to its top line, which saw it come out on top alongside Slaughter and May in the Magic Circle growth stakes. Though PEP only rose by a modest 3%, RPL of £789,000 puts A&O well ahead of Clifford Chance and Linklaters, if not Freshfields Bruckhaus Deringer’s £847,000 RPL.

The City giant’s mixed fortunes stateside have been well documented in the last few years, but recent developments, including the opening of a new Boston office, suggest that expansion eff orts are starting to pay dividends. A&O global managing partner Gareth Price offers insight into the strategy: ‘Private capital, sustainability and technology are our three themes. Our rationale is that tech affects all businesses, it’s not just a play for big tech. You see the hires we made in the US last year around tech, you can expect to see us continue on that.’

Georgia Dawson, Freshfields

Freshfields has also been making strides across the Atlantic. The firm, which saw a sound 7% rise in revenue and 8% uptick in PEP, doubled the headcount of its Silicon Valley outpost in the last 12 months, after a slew of hires on the West Coast.

Freshfields’ senior partner, Georgia Dawson, speaks of a market busy in all areas: ‘There was a lot of pent-up energy and pent-up activity that businesses wanted to press ahead with during a period of relative stability in the markets, so we were busy all around the firm in all of our markets and all of our practice areas as we supported clients as they got on with pursuing those objectives.’

Dawson adds that, despite a busy fee-earning year, the firm also found the time to focus on its ESG goals: ‘In addition to client work, we were able to press ahead with a number of other firm initiatives from our sustainability agenda and our D&I agenda.’

Elsewhere Ashurst, another firm with eyes on the US, enjoyed a robust year in keeping with recent form. A 12% bump to its top line from £711m to £798m, and a 13% rise in PEP to £1.175m, contribute to 48% turnover growth since 2017.

Chief executive Paul Jenkins is unsurprisingly upbeat: ‘It was the sixth year of significant revenue growth, with over 8% growth on average each year, and a 12% increase in the last financial year. We saw particular strength in the UK, continental Europe and Australia, underwritten by our global corporate M&A team delivering outstanding results. We continued to invest significantly in our people, with 29 lateral partner hires and the largest ever cohort of internal promotions to the partnership, with 25 new partners.’

Jenkins points to a post-Brexit continental push as a driver of the firm’s strategy, though emphasises that London remains a focal point: ‘We have had a strategic focus on our German offices over the last number of years and will continue to invest and strengthen our offering. Not surprisingly, as a consequence of Brexit we are seeing increased workflows. We have a strong financial services, real estate, infrastructure and disputes offering so we’ve seen that grow over the last 12 months, but the UK has been a real shining star across our 30 offices. Our London office had a stellar year.’

The sole new entrant to the business end of the table is Macfarlanes, which edges into this year’s top 25 at Irwin Mitchell’s expense. Widely appreciated for its striking PEP figure, which at £2.493m could only be bested by Slaughter’s £3.5m, the firm also mustered an impressive 16% boost to its top line.

Reflecting on a bullish year, Macfarlanes senior partner, Sebastian Prichard Jones, is suitably buoyant: ‘We have had a very broadly based performance. We were fortunate that all areas of the firm were busy and everyone therefore contributed, but in particular, we were lucky to be operating in a very hot part of the market in the alternative space. Across the piece, if you had decent exposure to alternative asset managers, you probably had a very strong year.’

Prichard Jones expects disputes to be the next practice to be built out: ‘We anticipate making more partners up in disputes. Th e demand is there, particularly in competition litigation as well as some financial services litigation. We are not confined by size in this firm. We think we have space to grow.’

Bryan Cave Leighton Paisner is the only firm in the top 25 to see revenue fall from last year, with a modest 4% drop. To some extent this may be attributable to the firm’s reporting calendar – which runs from January to December – as a 21% rise in PEP, the third-highest growth among top firms, suggests a strong year for the practice.

Thinking long term

The data shows that the turbulence of recent times has not stood in the way of firms’ long-term development. All firms in the top quartile have seen at least a 20% boost to their top line since 2017 (not including those which have undergone mergers in that time), with many seeing even healthier growth.

Fieldfisher is one such standout, doubling its revenue in five years to £330m. The last 12 months brought further confirmation of the practice’s upwards trajectory, as a 14% rise in revenue coincided with PEP surging 22% to pass the £1m mark for the first time.

Paul Jenkins, Ashurt

Rob Shooter, who is still getting his feet under Fieldfisher’s managing partner table having been elected to the role in May 2022, credits the firm’s long-term thinking: ‘We put in a clear sector strategy a few years back that has been successful and our ASL business Condor has produced exponential growth, as a result of a deliberate amount of investment in management time and resources. The Condor business is only going to get stronger.’

The firm’s success has not gone unnoticed by the market, either. Omar Al-Nuaimi, international chief executive of Osborne Clarke (which itself has grown 66% in the last five years), commends Fieldfisher’s progress: ‘I find it quite interesting to watch Fieldfisher.

In some ways it’s quite a similar firm to us. And they seem to be being quite successful with an almost similar strategy. A different market focus, but achieving similar things to us at a similar pace to us.’

CMS has also made significant strides in recent years, and its five-year 82% revenue growth has seen it become an established presence in the top ten since its merger with Nabarro and Olswang in 2016. The firm will be particularly happy with this year’s figures, as its 14% revenue rise to £644m dwarfs the 6% bump seen in 2021.

The firm’s prosperity, as well as that of the likes of Taylor Wessing and Addleshaw Goddard – both of which have experienced revenue growth well above the market rate in recent years – may speak to a larger trend. The narrative of the established City stalwarts losing ground to rivals from the States is well-trodden, but perhaps those firms ought to also be worrying about challengers closer to home.

As CMS managing partner Stephen Millar says: ‘To an extent, yes [leading city firms are being displaced]. The market is becoming much more open, mainly as a result of sustained investment by some of those outside the traditional Magic Circle, resulting in them becoming the optimal destination for work that historically went to the Magic Circle. We have invested heavily such that we have both scale and deep expertise across a huge number of specialist areas to be there for our clients’ biggest work as well as the day to day, being equally excited about both and focusing on what clients want.’

Into the unknown

It is clear that the turbulence of the last six months has yet to fully hit the profession, making the coming months hard to predict. A&O’s senior partner Wim Dejonghe wisely resists the temptation to prophesise: ‘Before mid-October it’s hard to decide on trends. Quite a few people seem optimistic, some a bit more cautious.’

Nevertheless, it doesn’t take a crystal ball to observe that a slowing of the transactional market is already being felt, and it is clear that the glut of deals is beginning to dwindle. As Al-Nuaimi describes: ‘It’s areas like the equity capital market fundraisings where things have just got pretty quiet. But that hasn’t stopped transactions happening.’

Omar Al-Nuaimi, Osborne Clarke

Even if the tides change, it need not be all bad. Uncertainty in the market will be music to the ears of restructuring and insolvency lawyers. Many firms highlighted distressed work as a strategic priority, with many bolstering their partner numbers. ‘We have been investing on the restructuring and insolvency side with partners recently joining the firm. That is going to be a central area where people are going to need support, but we still think there’s going to be plenty of transactional activity as well,’ notes Freshfields London managing partner Claire Wills.

Another common observation is that the City firms may be in a better position than their peers across the pond. Finkler recounts: ‘I went over to New York in May to talk to some of the law firms that we do a lot of work with and everybody was incredibly gloomy about how there was no work coming in and saying that they didn’t see transactions picking up until late autumn. I nodded my head sagely thinking; “that’s not how it feels over here.” We all keep waiting for things to quieten down, and it just hasn’t.’

Dejonghe echoes the sentiment: ‘Geopolitical tensions between US and China make it more likely for global transactions to tend towards English law. Same for Middle East, It’s why English firms are relatively stronger there than American firms.’

Whatever lies ahead, it cannot detract from a year that has provided yet more evidence that the legal sector can press ahead through almost anything. Shane Gleghorn, Taylor Wessing’s managing partner, concludes: ‘Our commitment to our sector focus is relatively unchanged by the projections about the macroeconomic environment. We believe that by remaining strong and building those areas of sectoral focus, we should be able to take more market share, even if the market in terms of deal flow is quieter in the next six to nine months.’

Legal Business and The In-House Lawyer would like to thank Keystone Law for their sponsorship of the Legal Business 100.