‘One day Alice came to a fork in the road and saw a Cheshire cat in a tree. “Which road do I take?” she asked. “Where do you want to go?” was his response. “I don’t know,” Alice answered. “Then,” said the cat, “it doesn’t matter.”’

Lewis Carroll, Alice in Wonderland

The above passage from Alice in Wonderland, says Daniel Jowell QC of Brick Court Chambers, is apt when planning for the possibility of the UK leaving the EU.

‘The UK is coming to a fork in the road but we can’t make a choice before we know where we want to go,’ he says. ‘If the electorate wants to take a different road then fine, that’s their prerogative, but we need to know what the road is before we can decide. If we are going to jump into a new relationship with Europe that looks very much like the existing relationship, then there really isn’t any point in changing track. Given that we’re having this referendum fairly soon, one would expect there to be more discussion of this, especially among lawyers. You need to know what lies [beyond] the referendum before you can reasonably be expected to vote.’

On 23 June British voters will be asked whether they want the UK to remain a member of the EU or leave. If the vote forces an exit, the post-referendum outcome will be complex for UK businesses.

As Timothy Less, director of the consultancy Nova Europa and affiliate at the University of Cambridge’s Forum on Geopolitics, points out, should the UK vote for a full exit it will not be a simple case of one political union leaving another. Changing the terms of a series of precariously balanced political relationships, Brexit could be an act that brings down both unions.

Recent polls suggest that those who wish to leave the EU now outnumber those who wish to remain but, as last year’s UK general election showed, opinion polls are notoriously unreliable.

Domestic relations within the UK are already strained. A Brexit vote could trigger Scotland’s departure and begin a debate about the future of the UK itself. The withdrawal of the UK from the EU, says Less, may even be the spark that ignites the powder keg under Europe, critically destabilising the balance of power and causing the complete collapse of a grouping mired in controversy and discord over the handling of Greece’s woes and the ongoing migrant crisis.

Even without such drastic consequences, the financial, legal and political repercussions of an exit vote will define Europe for a generation. With this in mind, we teamed up with Herbert Smith Freehills (HSF) to produce a special report on the topic, drawing on responses from more than 200 UK-based businesses, including a range of general counsel, regional counsel and chief executives.

Unknown unknowns

The 18 and 19 February meeting of the European Council resulted in an agreement that will be presented to UK voters in the referendum as the basis for remaining in the EU on modified terms. The deal, which came after months of high-stakes haggling, triggered an immediate commitment from Prime Minister David Cameron to go for a referendum on 23 June and to campaign for the UK to remain in the EU.

The UK could not sign up to Swiss-style treaties at the drop of a hat. It would have to negotiate with its trading partners.

Gavin Williams,

Herbert Smith Freehills

Cameron secured a number of compromises, including an ‘emergency brake’ allowing the UK to suspend in-work benefits payments to EU citizens – albeit one limited to seven years and not applied retrospectively to those already working in the UK – and restrictions on child benefits for EU migrants whose children are not resident in the UK. Perhaps the biggest change to existing EU policy was an agreement that a single non-eurozone country opposing a eurozone measure would be sufficient to delay regulations and introduce further discussion at an EU level.

For UK financial institutions there was also cause for optimism in the details of the agreement. Banks and insurers will be offered ‘specific provisions within the single rulebook and other relevant instruments’ to allow for differences between eurozone and non-eurozone entities.

However, the relatively modest concessions, as expected, did little to win over sceptics. Justice Secretary Michael Gove, Leader of the House of Commons Christopher Grayling and Mayor of London Boris Johnson were among the highest-profile members of the Conservative Party to back Brexit following the deal’s announcement.

Union blues: the winding road to the brink of Brexit

When it comes to Brexit, UK companies are keeping their cards close to their chests. Only 9% of respondents to our survey said their company had announced a public position, with the rest either taking no formal stance (39%) or not disclosing their position. Companies that had taken a public position were split between those that thought the UK should remain as part of the EU (56%) and those that thought it should leave (36%) or wait on the outcome of negotiations before giving an opinion (8%).

Respondents personally were more Europhilic. Over half (57%) thought the UK should remain in the EU, with the rest split between those who thought it should leave (25%) and those who were unsure (18%). General counsel were the most pro-European of the respondent groups, with 64% saying the UK should remain in the EU.This is not representative of the UK public as a whole. Opinion polls consistently show the British public is hostile to the EU. According to the last available Eurobarometer public opinion survey of member states, published in autumn 2014, only Greece and Cyprus have a lower estimation of the EU than the UK. How did it come to this? And is the UK’s low estimation of the EU likely to be a decisive factor in the upcoming referendum?

The European Economic Community (EEC), a predecessor of the EU, was established in 1957 by a treaty drawn up between Belgium, France, Italy, Luxembourg, the Netherlands and West Germany. While this six-nation community had clear economic objectives, not least the formation of a tariff-free Common Market, it was also born of an ideological mission to prevent the continent from sliding back into war.

The UK made two attempts to join the EEC in the 1960s before finally being admitted in 1973. On both occasions its membership was vetoed by Charles de Gaulle, who worried that the UK’s ‘deep-seated hostility’ towards the union would disrupt the EEC’s ability to make unanimous decisions. Inevitably then, when David Cameron set out his key demands in a letter to the president of the European Council last year, he called for Britain to be exempted from the principle of ever-closer union.

Whether deep-seated hostility will translate into a Brexit vote is finely balanced. Recent polls suggest that those who wish to leave the EU now outnumber those who wish to remain but, as last year’s UK general election showed, opinion polls are notoriously unreliable. The result has become even harder to predict given the Syrian refugee crisis, which saw around a million migrants flock to Europe last year, further inflaming tensions in Europe over immigration and freedom of movement.

The referendum question itself – ‘Should the United Kingdom remain a member of the European Union or leave the European Union?’ – is also one that invites uncertainty. The initial question met with protest from the UK Electoral Commission on the grounds that it presented the ‘remain’ vote as the default option (which, of course, was the government’s intention).

With a 23 June referendum date announced, the issue of Brexit is set to become a pressing question for UK businesses in the coming weeks. As far as the voting public is concerned, Stephen Booth, co-director of the independent policy think tank Open Europe, thinks it will be a close-run thing: ‘It’s still up for grabs. I think we’ll stay in, just. Most referendums tend to be biased toward innate conservatism and Cameron’s recommendation will count for quite a bit with swing voters. It will be a hard-headed and pragmatic vote rather than an outpouring of Euroscepticism or Europhilia.’

Ominously for UK plcs, news that the high-profile Johnson was joining the out campaign saw sterling plunge on 22 February, while Moody’s that same day issued a statement concluding Brexit would be damaging to the UK economy. The credit rating agency said the UK’s current Aa1 rating would be put under ‘negative outlook’ following a decision to leave the EU, citing uncertainty and warning of rising borrowing costs.

‘If you think of Brexit in terms of business risk then the risk is that nobody knows if there is a withdrawal what it will be replaced by,’ says Adam Johnson, disputes partner at HSF. ‘You’re at the mercy of EU legislators and even domestic legislators if you don’t know what requirements they’re going to impose in place of existing ones.’ Or, as Dorothy Livingston, a competition, regulation and trade consultant at HSF, puts it: ‘One of the things people should be worried about is that they don’t know what to be worried about.’

The House of Commons report concludes that 50% of the UK’s economically significant laws are derived from

EU legislation.

GCs are also frustrated by a lack of clear guidance. James McRobbie, GC of the energy risk management, trading and asset management firm CF Partners, says: ‘There’s a whole raft of things we don’t know at the moment that we would need to know to begin planning.’

‘I’m hoping,’ he continues, ‘that before the referendum the debate has at least reached the stage where the people pushing for exit from the EU have put together a case for how it would work in practice [and] what the government plans to do if it should happen. Until that time there is no sense spending resources catering for an unknown.’

James Starkey, chief legal officer at Cairn Capital, takes a similar view: ‘The issue of Brexit hasn’t reached the legal department in any significant sense yet. We would need some guidance on what would happen in order to plan for it. The messages from the government are unclear so we’re forced to adopt a wait-and-see approach.’

Businesses in a range of sectors are struggling to plan for Brexit. The introduction of tariffs would be a huge threat to UK-based manufacturers but David Symonds, vice president and regional counsel for EMEA at security systems company Tyco International, says a dangerous lack of information has been provided on whether the government would seek to avoid this outcome in post-referendum negotiations with the EU. ‘Will the government negotiate an arrangement that allows tariff-free access to the European market? If it doesn’t, it would be a problem for us, but we just have no idea on what its plans are. I find it very frustrating.’

While there is a lot of uncertainty surrounding the legal implications, most businesses are banking on a long post-referendum negotiation process during which these issues would be settled. ‘The expectation is once there’s a vote and a decision then we will start planning,’ says John Benson, head of legal at Commerzbank in London, ‘but it won’t be a switch – one day you’re in, one day you’re out – there will be a long transition period during which time we will work out our options.’

A second widespread assumption is that, even if the UK votes for Brexit, commerce and realpolitik will trump all else. Many expect the ongoing negotiations to yield a watered down series of British proposals that will be pushed through and ratified by the EU or, in the event of a ‘leave’ vote, a post-Brexit fudge restoring mutually beneficial trading relations. This may be the case, but to bank on it would be to underestimate the political machinations involved and the law of unintended consequences.

As Livingston says, ‘legal counsel may not be able to establish what the outcome of a referendum will be, but it is not impossible to work out what the legal implications for a business will be under the various Brexit scenarios’.

Some sectors will be directly affected by withdrawal from the EU. Financial services businesses will lose the passporting rights which allow them to carry out activities in any EU jurisdiction, whether they have a branch there or not. According to Johnson, UK telecoms and media companies are also likely to be significantly affected by Brexit.

Four paths

Should the UK vote to leave, its options, in broad terms, are signing up to the European Economic Area (EEA) Agreement; adopting something akin to the Swiss arrangement of bilateral treaties; adopting a Turkish-style customs union; or trading under pure World Trade Organization (WTO) rules.

The simplest model of non-membership relations with the EU is the EEA, a group consisting of Iceland, Liechtenstein and Norway, which, along with Switzerland, trades with the EU as part of the European Free Trade Association (EFTA).

Members of the EEA are permitted to trade in the single market without tariffs but must guarantee the four freedoms of the EU – persons and workers; capital; services; and goods. The potential advantage of this model is that it comes with a wider series of opt-outs on EU regulations, including the much maligned common agricultural policy and common fisheries policy.

The difficulty is knowing what you’re planning for. We have no idea on what the government’s plans are.

David Symonds – Tyco

However, EEA members are obliged to make a significant financial contribution to the EU and adopt all EU legislation relating to the single market. While the EEA is involved in consultation prior to the introduction of new legislation, the EU has always been clear that members of this group do not vote on EU matters. Essentially, members lose their influence over the EU but have to pay for the laws that are imposed on them remotely (what the Norwegians call ‘fax democracy’).

Critics of the EU often point to its burdensome regulations, but as Livingston notes, far from making regulations less onerous, Brexit would lead to a double burden for UK businesses that trade with the EU (trade which accounts for nearly half of all UK exports).

It is also difficult to see how the model would work in Britain’s interests. Iceland is a country of 330,000 that joined the EEA to retain control of its fishing rights. It seems wildly unrealistic to assume that the same model would work for a much larger economy.

A second option – the so-called Swiss model – is to agree a series of bilateral treaties with the EU that guarantee some but not all of the four freedoms. Ian Rogers QC of Monckton Chambers has much first-hand experience of the EEA system and believes this too would fail to meet the UK’s needs. ‘The Swiss system has about 200 treaties that got negotiated separately. It’s very complicated, it isn’t terribly effective and they still have to make a large financial contribution to the EU. Switzerland more or less has to follow the EU standards when it signs a trade deal. If it didn’t the EU would have to change its standards to suit the Swiss, which is just not going to happen.’

Gavin Williams, a corporate partner at HSF, also cautions against trying to copy the Swiss system. ‘It took a number of years for Switzerland to negotiate its relations with the EU and the UK could not just sign up to something similar at the drop of a hat. The UK would have to join a negotiation queue with all of its major trading partners and in the meantime would run the risk of having tariffs imposed.’

‘Brexit will be doom and gloom, but it will produce a tsunami of work for five to ten years. It will be good for lawyers.’

Thomas de la Mare QC – Blackstone Chambers

The EEA and EFTA models both preserve the free movement of persons, which may rule them out politically as tenable replacements in a referendum that hinges on restricting immigration from within the EU.

A Turkish-style treaty offering free movement of goods but not people might be a viable alternative, but it would lead to tariffs on services. Given that services account for 79% of the UK’s GDP, it is highly unlikely the government would seek a deal on these lines.

Livingston points out: ‘There is no existing model for a relationship with the EU that does not involve free movement of persons but which benefits services businesses. UK businesses, particularly financial services businesses, will be negatively affected by any Brexit outcome.’

A further problem identified by Stephen Booth, co-director of the independent policy think tank Open Europe, is that speculating on what will replace EU membership assumes the UK will withdraw on a single mentality, which is not in line with opinion polls. ‘Some [supporters of Brexit] want to move toward globalisation, others to a more protectionist regime. The UK could benefit economically from Brexit, but only by embracing globalisation more than we already do, and the vote is unlikely to be carried by those who want to see the UK become a European equivalent of Singapore.’

As our survey indicates, restricting the free movement of persons would also have a direct effect on UK businesses. Respondents identified the loss of free movement of workers between the UK and the EU as the biggest potential risk to their activities following a Brexit vote. The only other established option would be to go it alone and operate under WTO rules to access the ‘most favoured nation’ tariff (the route US businesses take when trading with the EU). This would allow the UK to avoid significant financial contributions to the EU budget but businesses would be subject to tariffs on exports. The introduction of tariffs would be a big hit to UK manufacturers but not necessarily a disaster for the economy as a whole.

According to a 2014 London School of Economics study led by Gianmarco Ottaviano and João Paulo Pessoa, 0.14% of UK GDP would be spent on these tariffs. This is less than the 0.5% of GDP currently spent on EU membership. However, tariffs are not the only barriers the UK would face if it left the EU, and barriers including product standards, anti-dumping legislation and labelling standards would still apply to UK firms trading with Europe together with any rules applied as conditions of continued access to EU markets. Taking these factors together, the study estimates that the net costs of leaving the EU would be somewhere between 1% and 3% of UK GDP over the next ten years, assuming trade remained relatively stable.

A recent survey of more than 100 economists by the Financial Times underscored the consensus among forecasters that the UK’s prospects would be damaged by withdrawal from the EU. Of those surveyed, 67 thought the UK’s economic outlook would deteriorate following a vote to leave, while none thought it would improve.

Trade is an important consideration. According to the Office for National Statistics, 44.6% of UK exports went to the EU in 2014. However, faster growth by emerging economies means this proportion has declined since 1999, when 54.8% went to the EU. Foreign direct investment in the UK from the EU is substantial, standing at 46.4% of net UK assets held by overseas owners in 2013, though heavier investment by non-EU investors since the banking crisis means that this has declined from 53.2% in 2009. The value of UK assets held by non-EU investors increased by 64% over the period, outpacing a 24.8% rise by EU equivalents. Some argue that these statistics suggest the UK has scope to diversify its trade away from the EU, but in so far as the non-EU investment in the UK is a stepping stone to access the EU as a whole, this is an attraction the UK would lose on Brexit.

Our survey shows businesses have similarly mixed feelings on how Brexit would affect their economic outlook, with respondents split evenly on the question of whether leaving the EU would make their business less likely to invest in the UK.

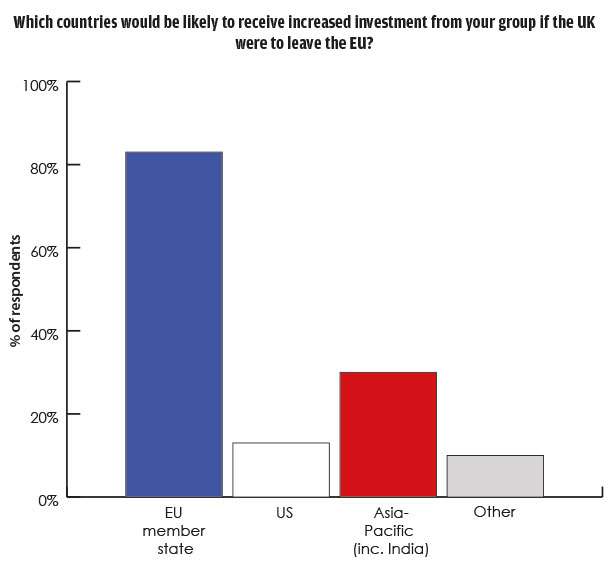

Half (50%) said it would have no effect on their plans, while the remainder said it would either lead to reduced investment in the UK (23%) or that they would have to re-examine their position once the outcome of negotiations became clear. Around a quarter (26%) of respondents said Brexit would have a direct effect on their existing activities, causing them to downsize or close UK businesses. Of those who said they would be likely to divert investment away from the UK, 83% said another EU member state would be the recipient.

Underlying the importance of services to the UK economy, only 50% said their decision over investment and business planning would be affected if the UK were to negotiate a customs union preserving the free movement of goods.

A Gordian knot

Establishing a new trading relationship with the EU that strikes a balance between the demands of the electorate and business is just

one of the post-Brexit problems the UK would have to face. In the

long run, disentangling the UK’s laws from those of the EU could present a bigger challenge.

‘Even if we get a perfectly amicable settlement with the remaining member states, we’ve been working toward a common legal framework for the past 40 years and we would need to establish [what] not being a member of the EU would look like again,’ says Dr Simon Usherwood, associate dean and senior lecturer in politics at the University of Surrey.

On that view, it could take a generation for the UK to work its way to full legal independence.

Sir David Edward QC of Blackstone Chambers, a former judge of the Court of Justice of the European Communities, is concerned that the complexities of Brexit are being swept under the carpet. ‘People haven’t got the faintest idea how much law has been accumulated in the 40 years since we joined. I would love to be a young lawyer again if that did happen: I’d certainly never have to worry about finding work.’

If there is a vote for Brexit, it could end up complicating the UK’s understanding of its own laws, according to Thomas de la Mare QC of Blackstone Chambers: ‘There’s going to be a flurry of litigation about how to interpret questions of validity in regimes inspired by EU law but no longer bound by it. From my perspective as an EU practitioner, Brexit will be doom and gloom, but it will produce a tsunami of work for five to ten years. It will be good for lawyers.’

According to Jacqueline Minor, the European Commission’s head

of representation in the UK, even the process of identifying which

laws need to be replaced would cause enormous turbulence to the domestic legal system. ‘You’re looking at hundreds of lawyers and civil servants engaged in a multi-year review of all legislation that entered through the EU. You’d have to ask a number of questions.

Did we choose a law? Did it come in as the result of an EU directive? And if it did come in as the result of an EU directive, do we want to keep it? And, if we want to repeal it, what do we want to put in its place?’

A further problem here is that EU laws are frequently backed up by an EU institution, such as the Court of Justice of the European Union (CJEU). The UK would not only need to go through the hardship of identifying those laws it wants to keep, it would also need to specify a replacement body to oversee the relevant legislation.

‘I’ve given a lot of thought as to what happens to our laws after Brexit and I can see a lot of problems,’ says Rogers. ‘Suppose a legal issue has always been resolved on the basis of a CJEU judgment but the CJEU is no longer available as a body to which the matter can be referred. It would be an absolute nightmare in terms of uncertainty. Even specific words in UK statutes can be subject to interpretation in light of European rulings, and if we are not in the EU system but the phrase remains the same we might run into problems of how to interpret our laws.’

There is no model

for a relationship

with the EU without free movement of persons but which benefits services businesses.

Dorothy Livingston,

Herbert Smith Freehills

While a lot of EU-originated legislation has become entangled with UK law over the years (see box, ‘How much UK law comes from the EU?’, page 44), it is often forgotten that the relationship works both ways. ‘The UK has an enormous influence in shaping EU law and that is lost on the public,’ says Rogers. ‘There is enormous respect for the common law. Our Supreme Court judgments are widely regarded throughout the EU and it is quite wrong to imagine that laws cooked up in Brussels are foisted onto the UK; if anything, the process works the other way.’

The fact that 93% of children in secondary education in the EU learn English also gives the UK a huge advantage in conducting negotiations. Even though the UK opted out of joining the single currency, English remains the official language of communication in the European Central Bank. It is also clear that other member states are increasingly receptive to the UK’s calls for reform of the EU.

Whatever the outcome, the advice from the legal community is stark. ‘Businesses should not be waiting to see what happens,’ says Livingston. ‘A Brexit scenario is no longer a remote prospect and even without knowing what we would Brexit into, legal counsel should identify which areas of EU law affect their business and draw up an assessment of how Brexit will affect them.’

Or, as Jowell says: ‘What we must do is think about this much more than we are doing.’

james.wood@legalease.co.uk