In the first part of this article, the authors looked at the trade in counterfeit goods in the context of the massive changes taking place in the world economy and suggested that China’s current pre-eminence as the major source of the world’s counterfeits might come under threat from other emerging ‘competitors’.

In part two, they consider how rights holders can best position themselves to deal with whatever the future throws at them.

DEVELOPING AN APPROPRIATE RELATIONSHIP WITH CUSTOMS

In a rapidly changing anti-counterfeiting landscape, access to timely, accurate and relevant information is crucial. Without it, rights holders and their partners will not be able to spot or anticipate trends, or allocate resources strategically. Developing an appropriate relationship with customs is crucial.

Given its ability to detain and seize shipments at borders, and, in most cases, its ability to share information with rights holders, customs should be considered a key partner. It has, over the years, recognised and embraced the important role it plays in the battle against counterfeits. In the last 20 years, we have seen massive improvements both in customs’ powers, and in the way that customs works with rights holders to ensure that it is as effective as possible. Its increased effectiveness is reflected in the massive increase in customs monitoring applications filed with EU customs over the last few years: in 2000 there were 981; ten years later, in 2010, there were 18,330.

But just engaging with customs is not enough. What is most important is the way you engage with customs and how you deal with the information that is obtained as a result.

It is important to develop an ongoing relationship with customs, and to ensure that customs officers are familiar with your brand and its distinctive features. It is also important to be aware of marketing trends and ready to provide different types of assistance to customs officers as the need arises.

There has, for example, been a massive change in the counterfeiting entrepreneurial landscape over the last five years, resulting in reduced transaction costs (advertising, payment processing, shipping etc). This has helped lead to fragmentation (ie distribution from bulk into smaller consignments, gradually getting down to individual sales) occurring much higher up the distribution chain. Whereas goods were previously shipped in bulk to end-user markets, where fragmentation would take place, fragmentation now increasingly occurs before goods are exported from the manufacturing source country (be that China or wherever). The recent experience of many rights holders shows:

- There is a growing class of entrepreneurs within manufacturing source countries sourcing from each other in small quantities.

- This leads to far greater visibility of counterfeit goods on internet trading platforms, not only within the source country or on local auction sites such as eBay, but increasingly sales targeting end-user consumers in far away markets.

- Consequently, there has been a massive growth in relatively small postal shipments direct to end users or multiple small-scale distributors.

As a result, very often the problem is not how to find a needle in a haystack (ie infringing goods concealed in a 40ft container), but how to deal strategically with an avalanche of small packages.

Savvy rights holders saw this trend early and anticipated its impact. They were quick to put in place measures to address this new phenomenon, one of the most important of which was the regular attendance of their own employees at the customs entry points for small packages, and the provision of assistance to customs with the examination of products.

Having customs programmes that have, at their core, the capture, retrieval and analysis of key data, will help rights owners pick up, at the earliest possible stage, trends that affect their particular industry, and determine the nature of the assistance they may be able to provide to customs. Rights owners should ensure they have:

- effective processes to capture, mine, analyse, share and act on relevant data;

- a database for storing the data – bespoke is almost always best, but, if off the rack, it must at least be carefully tailored;

- guidelines as to when data can be used and when it cannot; and

- a system for regularly analysing the data.

Good data will enable the rights holder to monitor the effectiveness of its efforts in a more enlightened (and enlightening) way than just tracking global spend on a year-by-year, country-by-country basis. With good data it is not difficult to see trends in the number of cases, the numbers of items, the expenditure, the punishments, if any, the types of products, the movements in source countries, end user countries and transit points, all tracked over the course of time: all vital information when it comes to allocating resources, and justifying their provision in the first place. To take a simple example, only with excellent data can a rights holder see whether a customs training session in a given country has a significant and sustained impact and thus assess whether (and when) to repeat it and where (if anywhere) to take the training next.

Graph one below, based on data from a typical programme operated by a major multinational consumer goods company, provides a good illustration. It tracks quantities of counterfeit product seized by customs, number of cases, and costs, over a four-year period and demonstrates that for this particular rights holder:

- there was significant success at the start of the programme;

- as time passed, there were more frequent, but smaller, consignments, which meant that despite an increase in the number of cases, fewer items were being seized;

- with the result that as the programme matured, the company found itself seizing fewer items per dollar spent.

THE IMPORTANCE OF GLOBAL STRATEGIES

Because the marketing of counterfeit products is an increasingly global activity, any strategy to counter it must be global if it is to have any prospect of success.

It is, for example, essential that effective engagement with customs takes place in all key territories so that the information obtained will enable rights owners to spot global trends early and be ready to act in the changing environment.

As noted in part 1 of this article, the rise of countries other than China as significant sources of counterfeits is inevitable. Most likely, there will not be a single rival to China’s current pre-eminence; there will be many, and the products emanating from each will vary, as will the routes to end markets. Whatever trends may emerge, spotting them early is vital, and will depend on developing, and implementing effectively, an appropriate global strategy. Waiting (and hoping) for the better customs administrations such as the EU and the US to publish their data puts you at least a year behind the earliest part of the curve and gives the counterfeiters a massive head start.

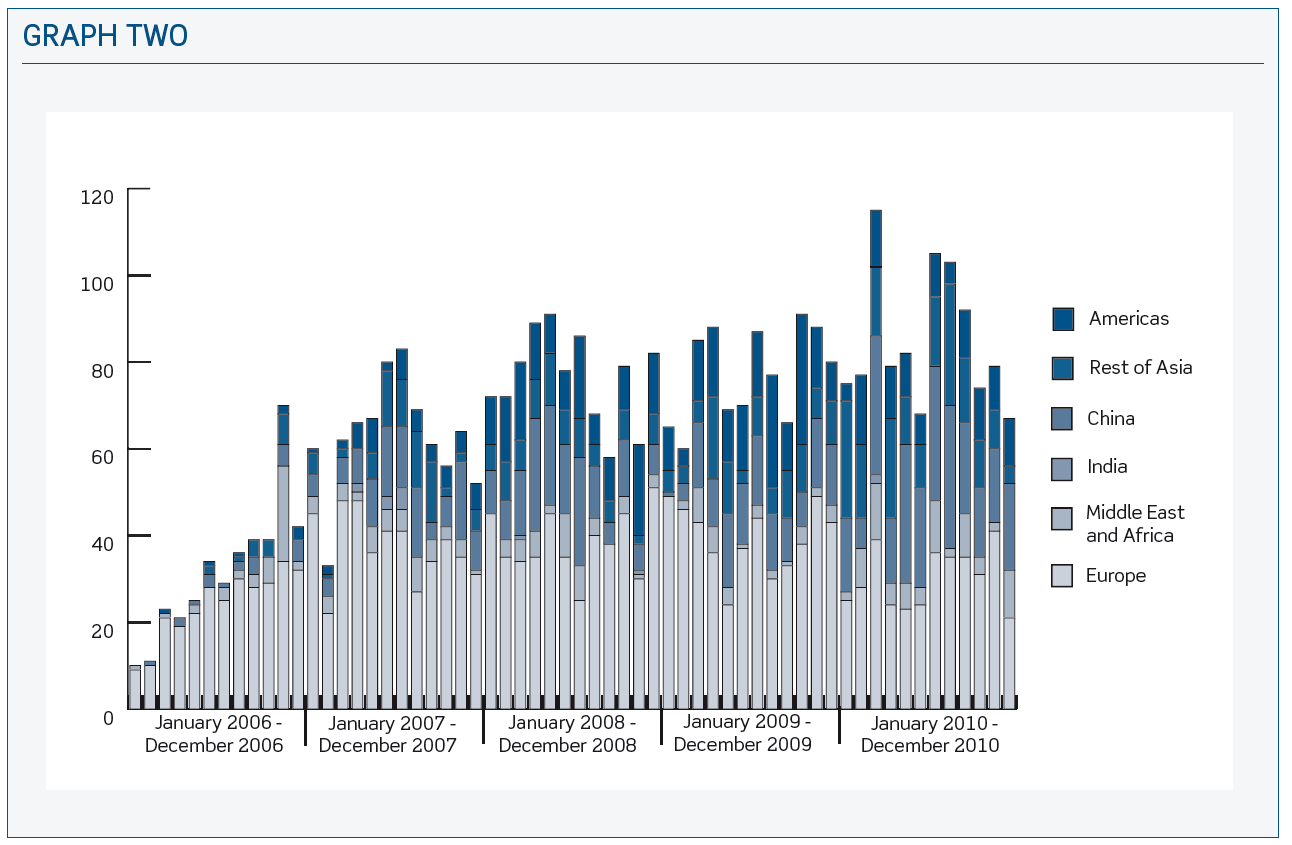

Graph two shows how the geographical spread of customs detentions evolved for a rights holder over a four-year period, with the number of cases in the EU gradually being matched by cases in other regions. This is vital information, which, provided it is monitored regularly, will provide the basis for determining an appropriate allocation of resources.

Without such a programme in place, the rights holder’s ability to deal effectively with tomorrow’s counterfeiting problem will be seriously compromised, leading, potentially, to a massive waste of already scarce resources.

CONCLUSION

Major changes are currently taking place in the counterfeit goods market as China’s position as pre-eminent supplier is being challenged. Which countries will be the main suppliers in the future is difficult to predict. It is, however, clear that without appropriate global strategies in place, rights holders will have little hope of success. And the key elements of any such global strategy should be the development and maintenance of appropriate relationships with customs in all key territories, and the collection, retention and analysis of accurate information.

By Luke Minford, partner, and Stuart Adams, partner, Rouse.